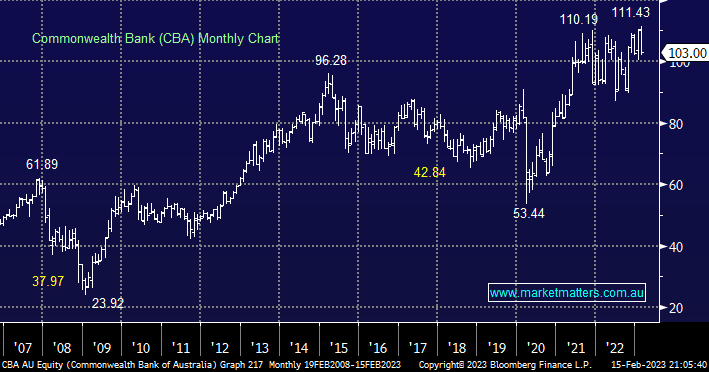

CBA tumbled -5.7% following its report yesterday, erasing most of 2023’s gains in the process. Before becoming too bearish it’s important to recognize the stock has run hard and was trading at a 43% premium to the sector versus its 5-year average of 24% – so it’s been more expensive than it normally is. As discussed the other issue is around competition in the mortgage market and with CBA’s NIM peaking in October and trending lower into the end of December it’s hard to justify a $110 price tag hence we took profit in our Flagship Growth Portfolio earlier this month.

CEO Matt Comyn also said they “expect business credit growth to moderate and global economic growth to slow during 2023”, not a big call but a tough backdrop to justify CBA punching through $110. At this stage CBA only has 0.43% of home loans which are more than 90-days behind on repayments, the lowest level we can remember, but as we all know this is the year when mortgage rates will take a huge hike for many Australians which is one of the reasons CBA has started to push into business banking more aggressively.

- CBA trades ex-dividend $2.10 fully franked next week, it will be interesting to see if offshore selling from investors who cannot benefit from franking credits eventuates.

After yesterday’s $6.25 plunge CBA is currently trading at 2.2x Price / Book Value which is in line with the +1st deviation historical average, and Est P/E of ~17x, which is at the upper bounds of the historical average ratings i.e. not cheap enough yet to entice us back in.