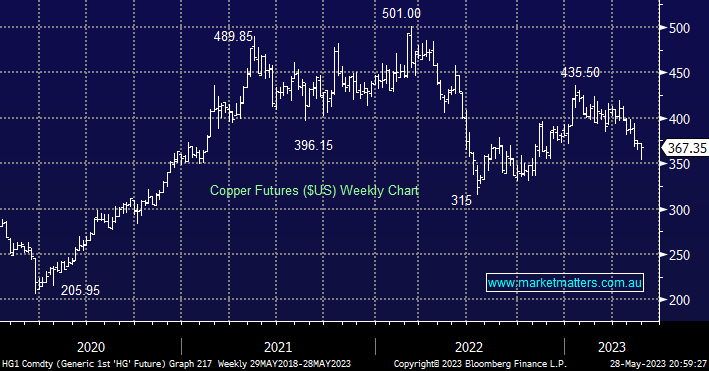

Over the last few months copper has fallen away embracing any economic concerns that are thrown its way i.e. the industrial metal is regarded as an excellent proxy for global economic strength. We like the risk/reward toward copper after its almost 20% pullback but a catalyst is still missing to send it higher e.g. economic stimulus from the PBOC (Peoples Bank of China).

- Further short-term downside for copper wouldn’t surprise us in line with our positive outlook for the $US but it’s a weakness we are looking to buy.

Crude oil continues to rotate in the $US70-80 region with recession fears continuing to prove more influential than OPEC+ output cuts at least for now – the market’s reaction to the US debt deal may provide some direction early this week. If we see another chapter of recession fears over the coming weeks/months, which punches the commodity under $US70/barrel, MM will be looking for a buying opportunity.

- No change, we believe crude oil is now “looking for a low” but it may take a spike below $US70 before it’s posted.