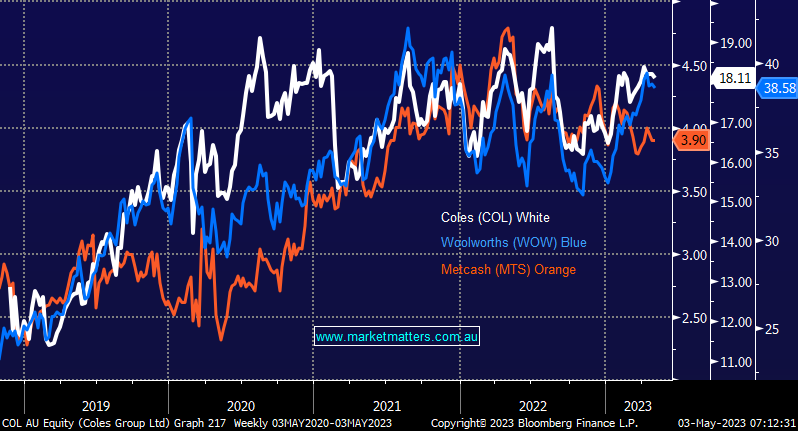

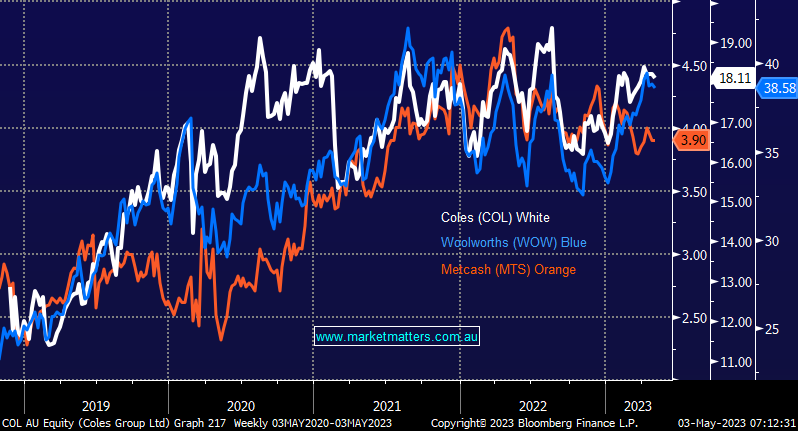

The two major supermarkets have reported quarterly sales updates this week at a time when Woolworths (WOW) is trading just ~10% below its all-time high while Coles (COL) is only ~8% below their equivalent milestone. Both reported strong results with WOW booking like-for-like sales growth for the 3 months to March 31 of 7.6%% while Coles (COL) said +6.5% more sales went through their tills. Inflationary pressures are pushing up prices elevating our overall grocery spend, and this is the primary driver of these numbers. On the other side of the ledger, they are experiencing higher costs through supply chain & input cost pressures, however just as the banks find it easier to expand margins as interest rates rise, supermarkets tend to do well in this sort of environment where the consumer can wear more than their fair share of the pain.

Woolworths, which has around 40% market share now trades on 25.9x projected earnings, around 14% above where it normally trades while it is the 3rd most expensive supermarket that MM can see out of 35 global peers. It is 19% more expensive than Coles (COL) which trades on 21.1x projected earnings, which seems a lot, however, it has traded at that premium since Coles was listed late in 2018. WOW is forecast to yield 2.72% fully franking for the coming 12 months while COL is likely to pay a more palatable 3.64% fully franked yield.

As we approach FY23 results, after-tax profits for Woolworths are expected to be up 11% to $1.68bn while Coles is likely to grow earnings by 4.2% to $1.1bn. These are very solid results, particularly from WOW and when we look forward it’s hard to pinpoint many near-term challenges to these impressive numbers from two high-quality, defensively positioned consumer staples stocks. However, with both trading on elevated multiples, while arguably they have past peak earnings due to inflation, it is very hard to get excited at current levels.

- We believe both Coles (COL) & Woolworths (WOW) are at the top of their respective trading ranges & we retain a clear preference for Metcash (MTS) under $4.00