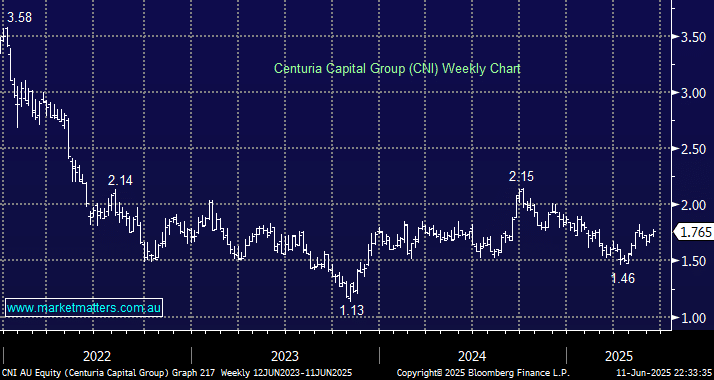

CNI has lagged the sector and market through 2025 slipping over 3% in a bullish market not helped by the consensus estimate for its dividend payments over the next year falling by 5% to 10.7c. However, this still puts the property fund manager on a more than 6% fully franked yield, well above that of the Australian 10-Year Bond yield. We believe this yield/interest rate differential will push CNI higher over the coming year (s).

- We remain bullish on CNI, especially for yield, targeting fresh 3-year highs through 2025/6: MM is holding CNI in its Active Income Portfolio & Emerging Companies Portfolio.