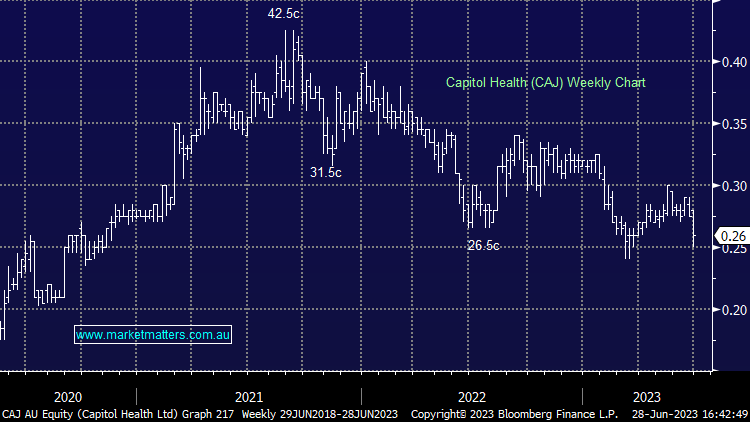

CAJ -7.14%; the diagnostic imaging company was out with guidance ahead of the end of the financial year which showed margins being squeezed more than expected. Revenue for Fy23 is expected to come in at $208m, largely in line with consensus, however, EBITDA has been guided to $39.3-40m, around 7.5% below expectations. The company said it had held on to staff numbers despite weaker volumes on anticipation of improving demand, signs of which have come through late in the 4Q. while not improving the current year’s numbers considerably, this should help build momentum into FY24. Also assisting the company is a bump to Medicare indexation which will increase payments for their services. While a disappointing set of numbers, the commentary suggests a turning point has been reached for the company.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

James on Ausbiz this morning talking markets

James on Ausbiz this morning talking markets

Close

Close

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM remains long and bullish CAJ

Add To Hit List

Related Q&A

Reporting update on 3 stocks- CRN, CAJ and MVF

Is Capitol Health (CAJ) making a come back?

Thoughts on Capitol Health, Austal and Standline Resources?

Thoughts on CAJ & SUL please

Thoughts on Audinate and Capital Health please?

What’s MM’s current view on Capitol Health (CAJ)?

Thoughts on – CAJ, HLS & ING please?

Any updated views on CAJ?

Does MM like healthcare stocks HLS & CAJ?

Capital Health (CAJ) + Super Retail (SUL)

When should we cut our losers?

Relevant suggested news and content from the site

chart

James on Ausbiz this morning talking markets

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.