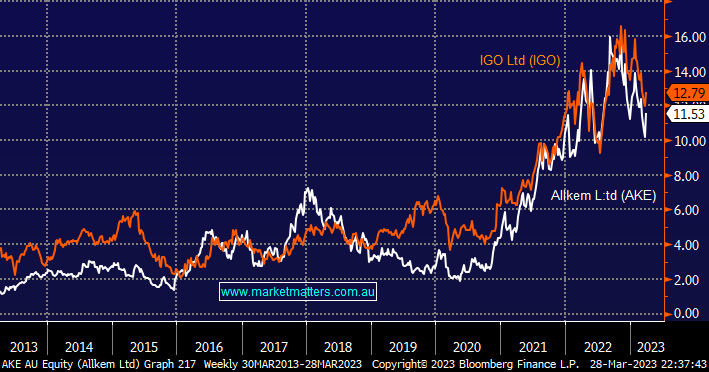

The combination of the $5bn bid for LTR and short squeeze across the sector sent the lithium sector significantly higher on Tuesday with Allkem (AKE) +13.7% and IGO (IGO) +6.8% two of the standouts. We believe the fundamentals for lithium are strong on a multi-year view although near-term risks remain but prices should stabilise mid-year/Q3 as contracts get renegotiated, provided China/World EV demand remains on track.

This morning we have addressed a couple of important and topical questions i.e. should we be reducing our lithium exposure into this short squeeze as we now hold both IGO & MIN or should we buy more as consolidation (M&A) across the sector is inevitable, lastly is IGO still our preferred exposure moving forward with Allkem (AKE) as an alternative we have discussed at times.

- The underlying lithium price has pulled back in 2023 and while the longer-term demand is building as EV usage accelerates the 2nd half of the equation (being supply) is the tougher one to forecast.

Allkem (AKE) $11.53

AKE is a $7.35bn QLD-based global lithium play that has Toyota on its register with a strategic 6.16% stake, the stock has rallied +2.6% year to date. Formed from a merger between Orocobre and Galaxy Resources in August 2021, Allkem (AKE) is a top 5 global lithium producer with operations in brine, spodumene, and hydroxide. AKE is geographically diverse, operating in Argentina, Australia, Canada, and Japan. Assets include Olaraoz (Argentina), Sal de Vida (Argentina), Mt Cattlin (Australia), Naraha (Japan), and James Bay (Canada).

Management is targeting growth to 3x production in the next 2-3 years and then 2x again from there while vertically integrating downstream, these numbers appear very attainable making the current 8.6x valuation for 2023 not overly demanding.

- We like AKE although acknowledge it operates in a sector that is subject to political, financial, and operational risks.

IGO Ltd (IGO) $12.79

The $9.7bn WA-based nickel and lithium miner has slipped -5% in 2023, the Creasy Group is the major shareholder with an 8.86% stake making this position in the battery metals stock their largest market exposure. IGO is a diversified Australian mining company that owns and operates the Nova nickel mine in Western Australia and holds a 49% interest in the Tianqi Australia Lithium JV (TLEA), giving it a read-through 24.99% ownership in the Greenbushes Spodumene mine and 49% of the Kwinana Lithium Hydroxide refinery.

Over recent times we have been major believers in the company’s takeover of Western Areas but the markets now questioning the future demand for nickel as the likes of Tesla invest heavily in the development of lithium iron phosphate batteries which negates the use of expensive nickel and cobalt – the nickel price has fallen more than -30% over the last 6 months.

- We like IGO but are conscious of the rapidly evolving EV market which might work against this lithium-nickel battery metals company.

IGO has already corrected 32% from its November high as it tracked the nickel and more recently lithium price lower, while we believe the potential transition in battery technology is priced into IGO around $11.50 it does dampen the longer term picture.

Conclusion

We like both AKE and IGO although further volatility is likely moving forward. At this stage, we are unlikely to change our sector exposure or switch between IGO and AKE but we are watching developments on the battery front very carefully.