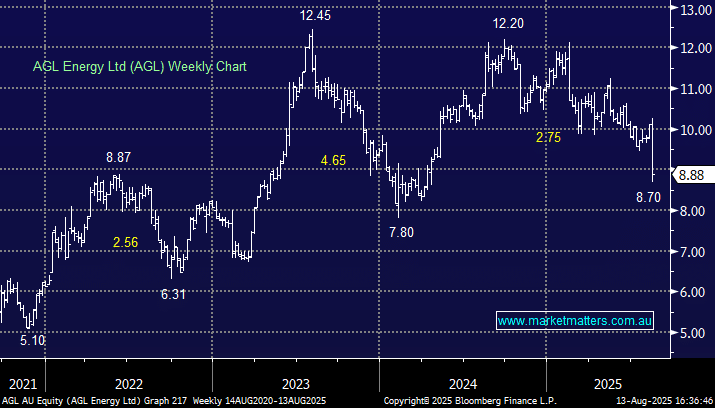

AGL -13.11%: disappointed as FY25 annual profit and FY26 guidance fell short of expectations, prompting a steep dividend cut. The stock slid as much as 14% to a new 52-week low, marking its sharpest one-day fall since October 2007.

- Revenue grew 6.0% to $14.39 billion from $13.58 billion.

- Underlying profit $640mn, -21% YoY, missing expectations by ~5%.

- Underlying Ebitda $2.01bn, -9.3% YoY.

- Underlying EPS $0.951 versus $1.027 YoY.

- Final dividend was cut almost 30% to 25c versus 35c YoY.

Looking ahead, AGL is banking on renewables to revive its fortunes, but its FY26 forecast came in about 11% below expectations. Overall, the result was underwhelming, prompting us to reassess our position in the MM Active Income Portfolio.