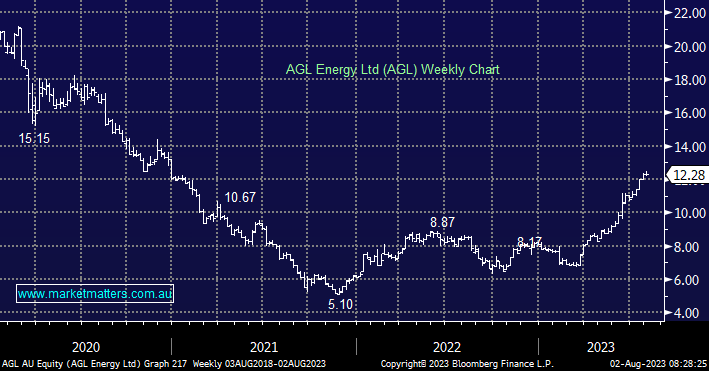

AGL has been the best-performing stock in the Market Matters Income Portfolio since its inception in 2017 with an aggregate gain of 138.64% achieved via three separate trades starting in November 21. Originally bought at $5.35, it was sold at $8.38 7 months later, acquired again at $6.83 in Sep 22 before selling out in Dec 22 at $8.07. Our current position was bought in Feb 23 at $6.95 and while we trimmed it at $8.59, we still hold 75% of the holding which is showing an unrealised gain of 76.44%. While this is not the norm (we wish it was), there are a few lessons here:

- Long-term downtrends are not broken easily, and re-tests of the lows often occur.

- Big moves can happen in large stocks when market positioning is set one way.

- Things change, businesses can reinvent themselves and poorly performing companies can turn, just as those high performers can lose their way.

Looking forward is what matters in investing and thinking about the future, what can change and what that change could mean is the real key. This typifies what we attempt to do each day at MM as we look forward and make educated calls about what could come next, ultimately trying to make more good decisions than bad. We think this is what adds true value to our service.

In the interest of looking forward, it’s very important to manage a position that has done well, perhaps more so than one that has not. As individual positions rise more than the portfolio as a whole, the weighting gets bigger and therefore so does its influence on performance. This is different to a position that falls more than the portfolio, its influence reduces over time.

- AGL represents a larger weighting in the portfolio following its advance, and given the significant re-rate in the share price and the change in view from the market from bearish to bullish, we now believe it’s time to trim the position back to the targeted 3% weighting. This is the approach we are taking via Market Matters Invest.