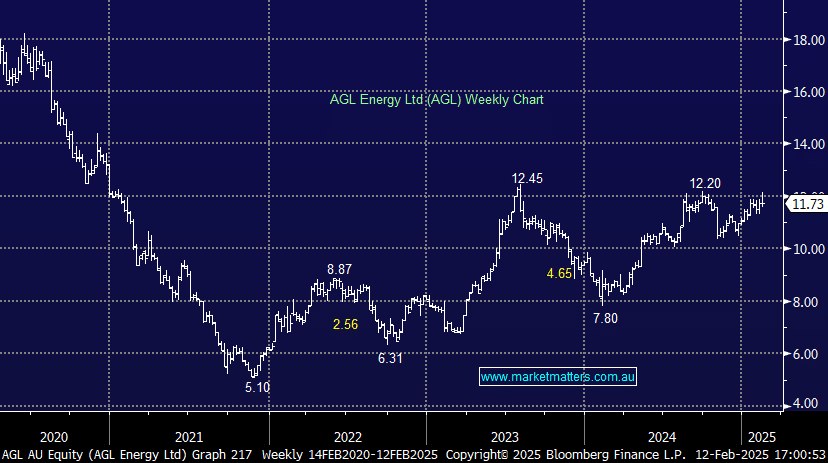

AGL +0.17%: announced strong 1H25 performance, with earnings beating expectations as the market reacted positively in the morning before the move faded as focus shifted from positive short-term performance to the full-year result and beyond.

- Revenue $7.13 billion (+15% y/y) vs. estimate $6.74 billion

- Underlying Ebitda $1.07bn (-0.6% y/y) vs. estimate $1bn

- Interim dividend per share $0.23 ($0.26 pcp) vs. estimate $0.20

- FY25 EBITDA guidance narrowed to $1.94bn-$2.14bn from $1.87bn-$2.17bn

The key driver for earnings was the electricity generation fleet which benefited from higher realised prices through the period. Full-year EBITDA consensus sits at $2.06bn, so narrowing top and bottom end guidance suggests moderated earnings in the second half. Of note, margins in the consumer segment were pressured by lower customer pricing due to increased competition.

We feel comfortable with the narrowed earnings range but are conscious this may cause an outsized move in the event of a full-year earnings miss in August. We continue to own the stock in our Active Income portfolio.