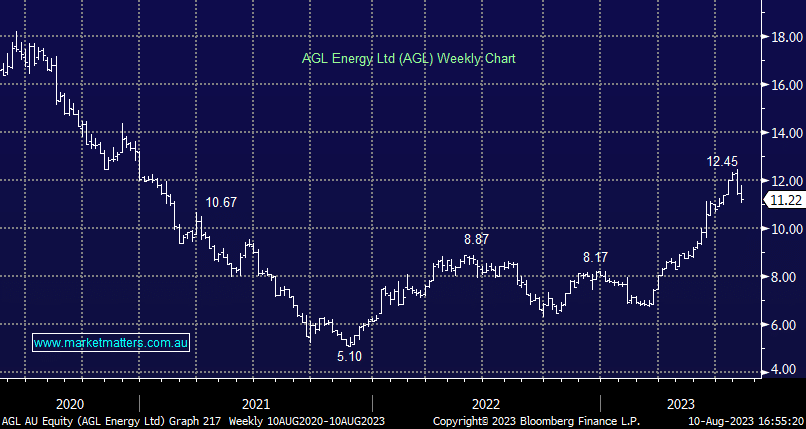

AGL -3.11%: The first inline result for ages from AGL and it was initially taken favourably by the market with the stock up 1.5% before the conference call started at 11am, before it was sold off to finish down on the day. The FY23 result was as per expected while guidance was unchanged for FY24, having flagged this at their investor day in June. FY24 EBITDA should be in the range of $1,875-2,175m with NPAT $580-780m. The dividend for the 2H23 of 23cps was a whisker ahead of expectations (22cps) and they may start to frank the dividend in FY25.

The focus today was on ‘what’s new’, and there wasn’t much since the June update. They are well underway on a huge realignment of the business, and they’re generating enough cash flow given favourable trends in the energy market to execute the strategy towards renewables. There is some risk that pricing dynamics could change, and that could impact their ability to fund such a significant program, and we’re unlikely to get more information here until early in 2024. We should also be conscious of the possibility of regulatory invention, the government loves to meddle with energy policy.

- We ensured our holding in AGL was brought back to our 3% target ahead of today’s results, and now we’re comfortable holders.