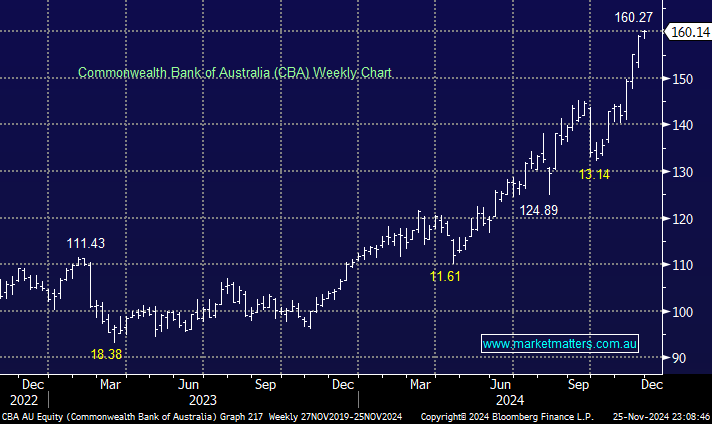

CBA is, in many ways, the opposite of exciting, but when a position is up over +200%, the label does fit! The financial press and brokers have regularly told investors through 2024 that the banks are too expensive and a sell. The MM Site shows that analysts are in agreement towards Australia’s largest stock: 2 Holds, 9 Sells and 2 Strong Sells with an average target of ~$101. The overvalued story has proven very wrong, and analysts will be forced to fall on their sword at some stage; we can see $200 before $100!

This is Australia’s premier bank and one of the best on the planet. They are way ahead of the opposition in costly tech and while its yield has diminished to less than 3% fully franked, the share price appreciation has more than compensated. We couldn’t chase it at current levels, but the path of least resistance is up as passive money continues to be a forced buyer! The current share price rhythm tells us to buy $10-$15 dips and be careful picking the top; staying long is easier.

- We see no reason to cut/reduce our CBA position – MM is long CBA in our Active Income Portfolio.