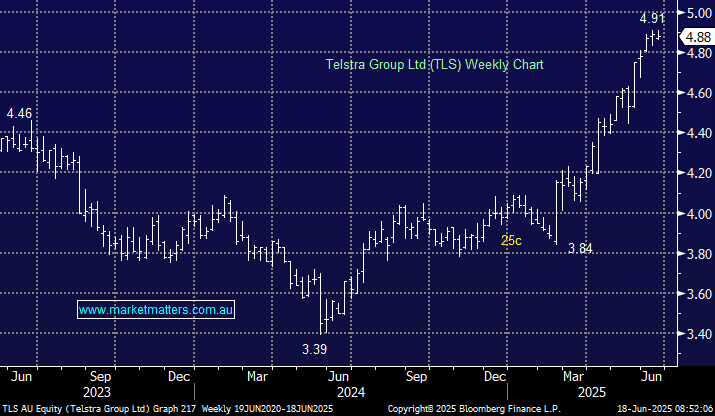

Telstra (TLS) is now stretched from a valuation perspective, and with a yield sub 4% and capital growth potentially limited in the short term, we see better opportunities for yield by establishing a new fixed income position (DN1).

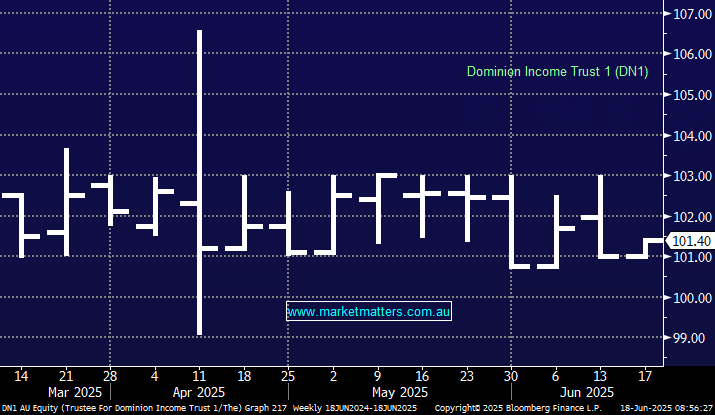

Dominion Income Trust (DN1) invests in a cross section of fixed income with a bias towards Residential Mortgage Backed Securities (RMBS), yielding in excess of 7%. We are switching from TLS into DN1 for better income and lower capital risk in the short term.