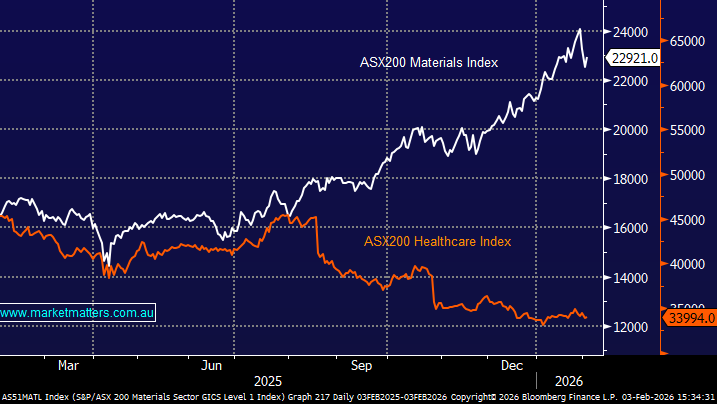

It’s not just the software stocks that have struggled in FY26; the healthcare sector is not too far behind – over the last 6-months the ASX tech sector has fallen 34%, with healthcare 24%. Two previously adored sectors are dominating the losers’ enclosure. While heavyweight CSL Ltd (CSL) has caught the headlines in the sector’s news, tumbling 33%, the likes of Cochlear (COH) and ResMed (RMD), have both retreated -15%, and have contributed to the underperformance. A couple of factors have fuelled the sector’s fall from grace, which is more noticeable considering the US equivalent has rallied +25% over the same period:

- The U-turn by the RBA from doves to hawks has weighed on high-value growth stocks such as healthcare.

- Momentum traders have used growth stocks to help fund their stampede into the ASX resource names.

- Heavyweight CSL has an outsized impact on our local sector, accounting for over 50% of the ASX Health Care Index.

If we’ve already witnessed an inflection point for the resources sector, &/or it’s as “bad as it gets” in terms of rate hike fears, the healthcare sector could snap back into vogue in the blink of an eye. Remember, we’ve already seen what happens when crowded trades unwind in recent days across the metals space – overnight moves in the US suggest it’s time to start watching for potential rotation as opposed to wading into the potential shift.

This morning we’ve dived into RMD, the $53bn sleep apnoea stock which struggled along with its peers in FY26.

Last week RMD delivered a better-than-expected 2nd quarter result with revenue and earnings (NPAT) coming in 2% above expectations, aided by strong US growth. Solid growth in Americas devices, up +8% YoY and masks/accessories +12% YoY was driven by solid re-supply and new patient set-ups. Also, gross margin of 62.3% was +310bps YoY. However, on the negative side, an uptick in costs and a strong $A dialled back the market’s initial enthusiasm.

RMD has generated an impressive free cash flow of $US1.8bn over the past 12 months, with a net cash position of US$753mn at the end of December, supporting ~$US600m of buybacks in FY26. At MM, we anticipate continuing further solid free cash flow generation, with capacity for further capital management and/or acquisition opportunities. For FY27, we expect a buy-back of US$175mn per quarter, but management is actively pursuing acquisitions, evaluating particularly potential tuck-in acquisitions of up to US$500mn – this could rein in the buy-backs slightly. Importantly, they are saying the right opportunity has to adhere to RMD’s 2030 strategy, meet ROI and FCF hurdles, and fit culturally.

- We believe RMD is a very high-quality healthcare stock that’s delivering operationally but being dragged down by general selling in the sector.

Encouragingly, patients with Obstructive Sleep Apnoea (OSA) diagnosis and prescribed a GLP-1 drug are 11% more likely to initiate Positive Airway Pressure (PAP) therapy and have higher PAP resupply rates 1 year (+3% higher) and 3 years (+6% higher) post setup. Also, the world is looking to become healthier, and the increased use of smartwatches is identifying OSA issues, which is helping the take-up of RMD’s products.

- The arrival of Ozempic & Co incorrectly created panic selling in RMD; the opposite is actually playing out.

RMD delivered $US5.1bn revenue in FY25, which is expected to grow by around +10% pa over the coming years, yet the stock is trading almost 30% below its average 5 year valuation. We see no reason to fight the tape yet, but value is becoming compelling, and we have added RMD to our Hitlist.

- We believe the largely indiscriminate selling in the healthcare sector is creating an opportunity in RMD.