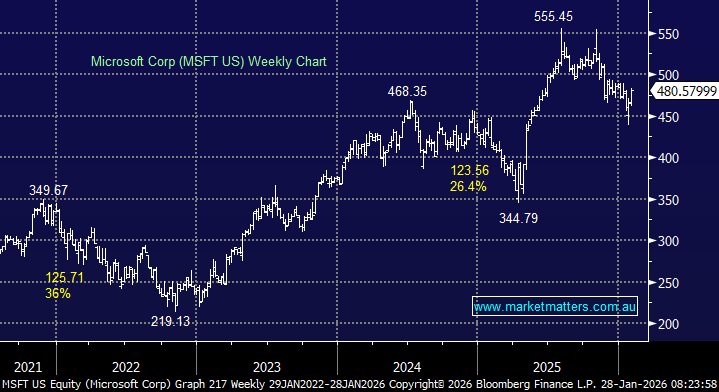

We’ve written on multiple occasions that Microsoft is a must-own stock for growth-oriented investors, one that balances the risks of large-scale digital transformation with the significant opportunities it creates. Since peaking in December, MSFT has fallen nearly 20%, caught up in a broader global sell-off across software names.

The concern driving weakness is that traditional software vendors could become AI casualties rather than AI beneficiaries. Rapid advances in AI-driven coding and development have raised fears that businesses may increasingly bypass expensive, off-the-shelf software in favour of cheaper, bespoke, in-house solutions. We don’t subscribe to this view for Microsoft and see the recent pullback as an attractive entry point ahead of results later this week.

Buying ahead of earnings does add risk, but Microsoft’s track record is strong. Over the past decade, the company has missed expectations only twice (3Q16 and 4Q22), delivering an average EPS beat of +8.8%. Because this consistency is well understood, the average share price reaction the day after results has been relatively muted, at +0.39%. This time feels different. With the stock entering the result from a much lower base, we believe positive expectations are less fully priced in, skewing the risk-reward more favourably.

This week, Microsoft also announced the next generation of its in-house AI chip, aimed at reducing reliance on processors from Nvidia and competing offerings from cloud peers Amazon and Google. Management claims the new chip delivers ~30% higher performance at the same cost. It will initially be used internally and across Microsoft 365 Copilot for commercial clients, with broader availability over time. While not immediately revenue-moving, this is another important building block in Microsoft’s vertically integrated AI strategy.

- At current levels, MSFT is trading around one standard deviation “cheap”, on 26.7x earnings, with consensus expecting ~17% earnings growth per annum over the next three years. In our view, that remains compelling for a business of this quality, scale and strategic positioning.