- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

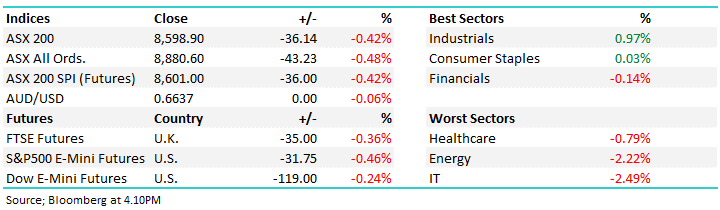

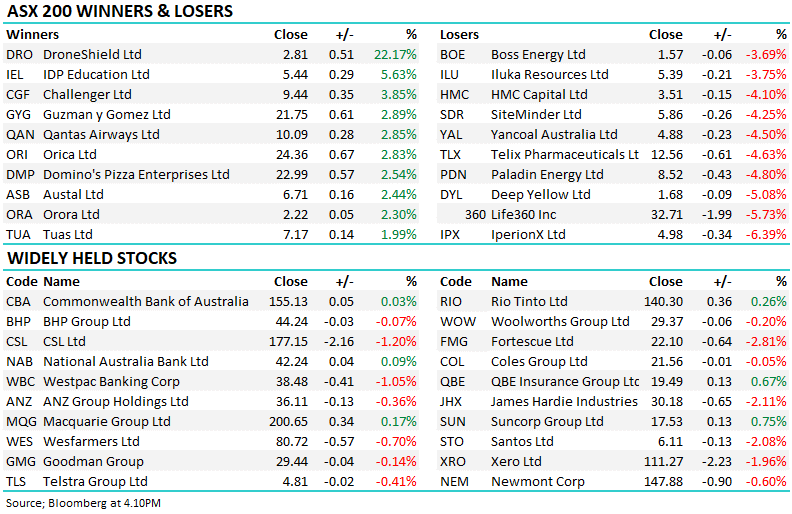

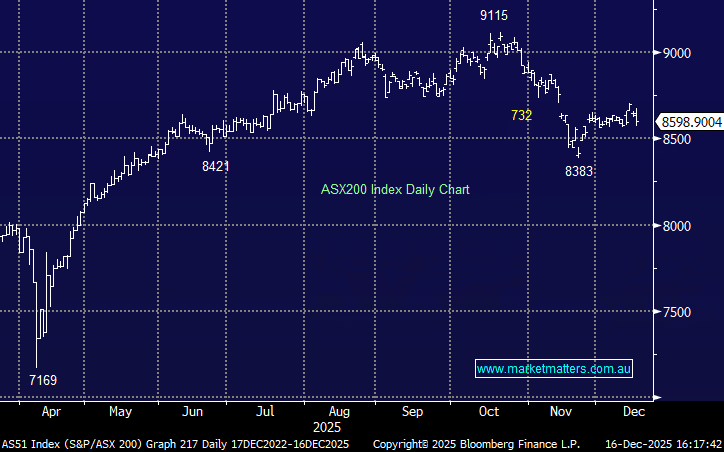

The ASX traded lower on Monday, giving back 70% of Fridays strong rally. Selling was broad based, with 10 of 11 sectors in the red with a sharp commodity selloff headlining the weakness as copper, iron ore and lithium stocks got whacked. Market’s now look ahead to Australia’s mid-year budget update and central bank meetings in the UK, Europe and Japan.

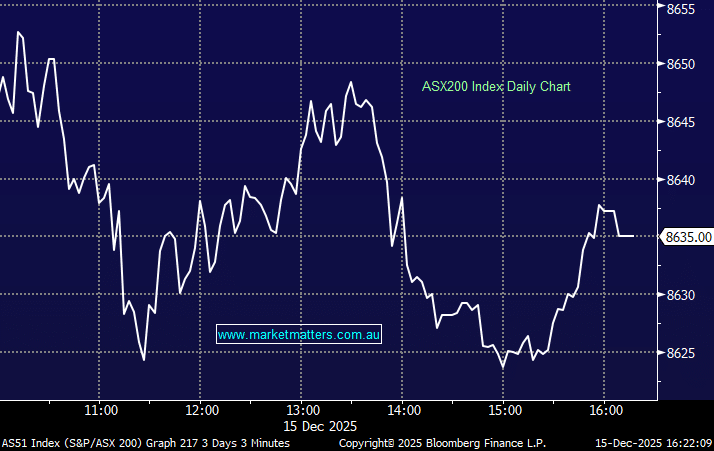

- The ASX200 fell -62pts/-0.72% to close at 8635.

- Consumer Discretionary (+0.54%) was the lone sector higher.

- Materials (-2.2%), Healthcare (-1.21%) and Energy (-0.81%) felt the worst of it.

- Materials led declines after a risk-off move in commodities. Copper fell more than 3% late last week, and iron ore slid following China’s decision to introduce licensing requirements on steel exports from January.

- BHP -2.9% and Rio Tinto (RIO) -2.4% were the worst hit in the materials space.

- Gold stocks saw profit taking – Newmont (NEM) -0.8% Northern Star (NST) -2% and Evolution Mining (EVN) -3.7% all lower.

- ASX Ltd (ASX) -5.7%% fell sharply after agreeing to governance reforms following an ASIC report. The exchange will hold an additional $150m in capital and cut its dividend payout ratio to 75–85%.

- Westgold Resources (WGX) -2.8% declined after receiving approval to demerge its non-core Reedy and Comet assets into Valiant Gold, with an IPO targeted for the March quarter.

- DroneShield (DRO) +10.1% topped the market, extending a volatile run that’s seen strong gains over the past week but still down over ~50% from its highs a month ago.

- 4D Medical (4DX) +9.4% rallied after securing regulatory approval to deploy its CT:VQ software across Canada via Philips.

- Tyro Payments (TYR) +1.5% % edged lower as it announced the acquisition of SME fintech platform late on Friday.

- IperionX (IPX) -0.5% dipped despite securing a prototype order to supply titanium components for US Navy pump systems.

- Dexus Convenience Retail (DXC) was flat firmed after reporting a $20m valuation uplift driven by cap-rate compression and rental growth.

- Bitcoin rose 1.8% to be trading around US$79,700.

- Gold traded up $35/oz during the session to $4333oz around the close.

- Iron Ore in Singapore was down 0.7% at $101/mt at our close.

- Asian markets were weaker, with China -0.2%, Hong Kong down -1.1% and Japan -1% lower.

- US futures are up ~0.3%.