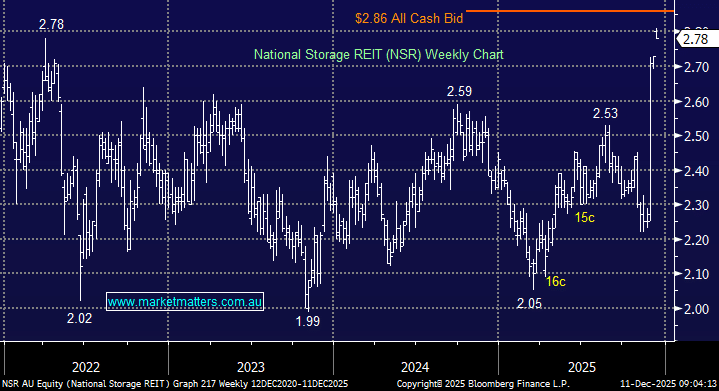

We are taking profit on National Storage REIT (NSR) following the takeover bid from Brookfield/GIC at $2.86. With the shares trading around $2.80, and the deal not likely to complete until 2Q26, we are re-allocating the funds elsewhere.

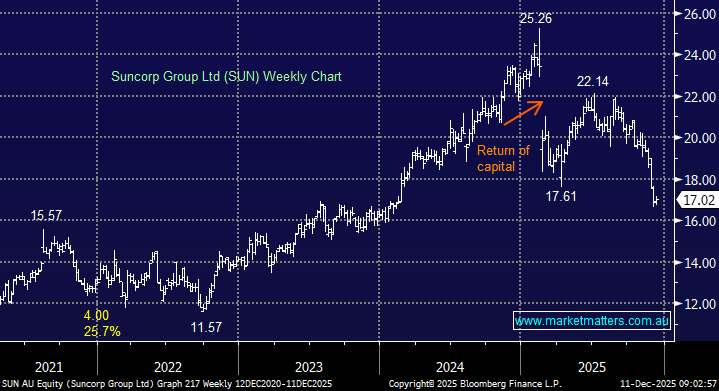

Suncorp (SUN) has had a challenging period with higher claims likely to impact earnings. We view this weakness as a buying opportunity, in a reasonably priced insurer paying ~5% fully franked yield.