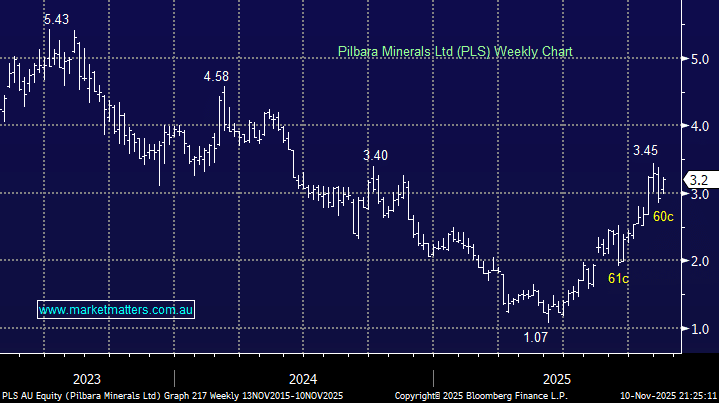

PLS rallied over +9% on Monday, rapidly regaining much of its recent ~17% pullback. PLS have continued to outperform operationally, posting stronger-than-expected production and solid realised prices despite a weak lithium market. Its cash balance remains significant at ~$850m, and remains well positioned for further price recovery, but valuation support looks limited until Li prices move meaningfully above $US1,000 – not far now! We can see the support coming from growth in Energy Storage Systems (ESS) driving PLS higher, especially with a whopping 14.5% of the stock still held short.

- We can see further upside, initially towards $4, with an aggressive short squeeze a real possibility.