NAB -3.3 %: The FY25 result landed largely in line with expectations as the Big Four member posted second-half cash earnings of $7.09 billion vs expected $7.2bn, narrowly missing consensus by 2% as growth in business and personal banking was offset by higher expenses and impairment charges.

- Cash Profit +$7.1bn (–0.2% YoY)

- Business & Private Banking Profit +1.6% to $3.3bn

- Personal Banking Profit +9.9% to $1.3bn

- Costs jumped +4.6%, including $130mn in payroll review and remediation costs

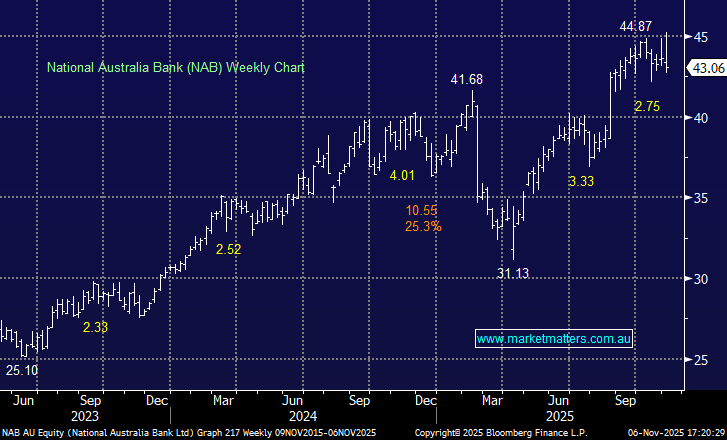

As we flagged earlier this week, NAB was priced for a broadly in-line result and it missed. The stock remains okay value trading on ~18x FY26, yielding roughly 3.9% over the next 12 months, but now looks like it is lagging Westpac (WBC), which delivered a cleaner and more upbeat update last week. Competition is also intensifying with ANZ, as it ramps up its business banking spend – we will get to see a glimpse into early days when it reports Monday 10 November.

NAB continues to execute though seems to be coming off the boil slightly in their business banking division, with cost inflation and softer margin trends prevailing. We still prefer WBC, and ANZ based on valuation and growth over the medium term.