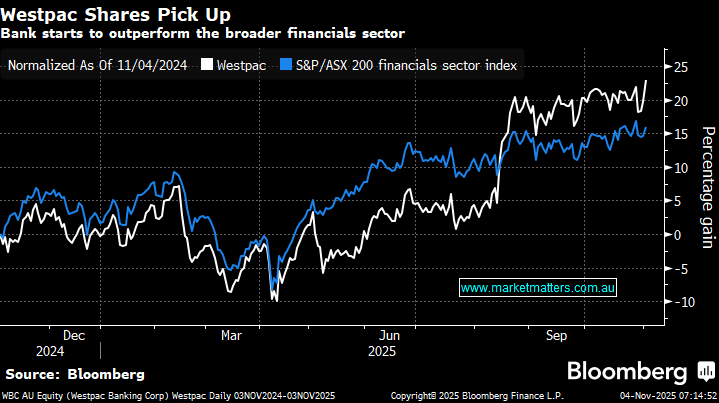

Westpac (WBC) delivered a solid update on Monday, with improving loan growth driving the stock higher. New CEO Anthony Miller has started to execute on the upgrades across the three banking platforms, although we must remain conscious that IT spend/upgrades can blow out. If he gets this right, WBC could continue to outperform over the coming years.

- So far in 2025, WBC has advanced +23%, with only turnaround ANZ +30% trumping its performance – CBA is languishing ‘only’ up +14% after its blowoff rally into EOFY.

With WBC set to trade ex-dividend 77c fully-franked on Thursday, placing the stock on a ~4% yield, we can see strength continuing over the coming sessions, but it is hard to see significant upside above $40 without fresh news. We remain long WBC in our Active Growth Portfolio, with the valuation difference between it and CBA still not leading us to consider a switch into Australia’s leading bank – CBA is trading on 27.8x compared to WBC on 19.1x.

- We continue to prefer ANZ and WBC as our top 2 banks into 2026, both of which are held in our Active Growth Portfolio.

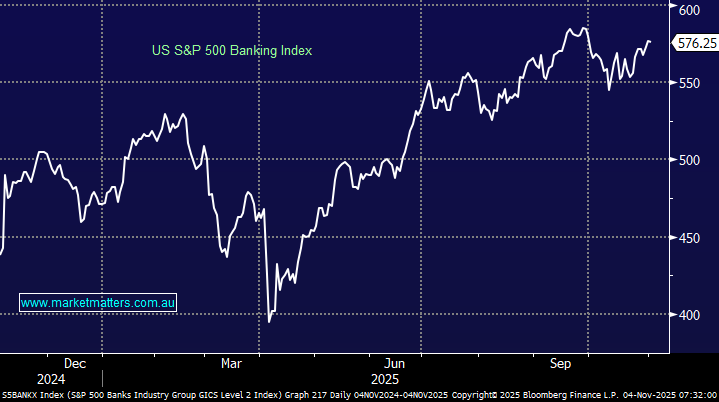

US banks have enjoyed a similar advance to the local index although they’ve experienced elevated volatility as some of their regionals endured a tougher period. Importantly, we see nothing from the US banks to concern us with the local names, although never say never with US banks not as regulated as the local names. When it comes to tech and AI, the US is leading the way, but not so with the banks:

- The banking sector is one area where the local stocks match up to their US peers.

This morning we’ve briefly updated our view on three banks currently not held by MM. As always, we remain open-minded to potential switches within sectors, and as we’ve seen with the ASX banks, relative performance can be very polarised.

- Year to-date: National Australia Bank (NAB) +19%, Commonwealth Bank (CBA) +15%, while Bank of Queensland (BOQ) has advanced just +3.4% and Bendigo (BEN) has retreated -2%.