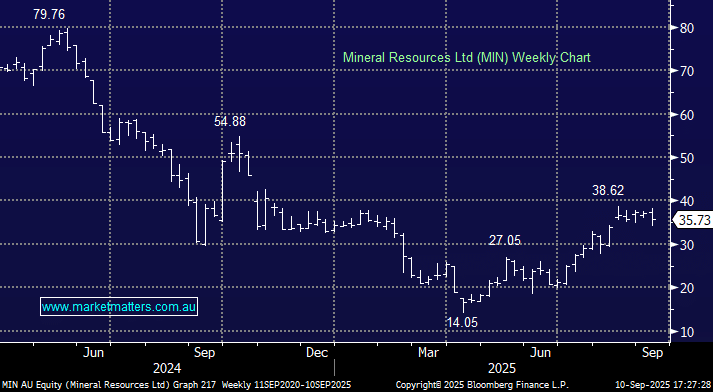

MIN’s FY25 report last month contained no nasty surprises, and its immediate focus on strengthening the balance sheet is reassuring. The stock only fell 6.3% on Wednesday, a win compared to other lithium names. However, less than 15% of MIN’s revenue came from lithium in FY25 – we regard MIN as an iron ore miner with a healthy mining services division, which has exposure to two major lithium mines in WA: Mt Marion (near Kalgoorlie)– a joint venture with Ganfeng Lithium, one of the largest lithium concentrate producers in Australia and Wodgina (Pilbara), a major hard-rock lithium mine, jointly owned with Albemarle, currently one of the biggest spodumene deposits globally.

One of the reasons we like MIN, although it still carries a large load of debt, is that these lithium resources and their potential upside aren’t being fully reflected in its valuation. However, as we saw recently with LTR, there is an appetite for the sector at current levels.

- We are still targeting the $45-50 area for Mineral Resources: MM owns MIN in its Active Growth Portfolio.