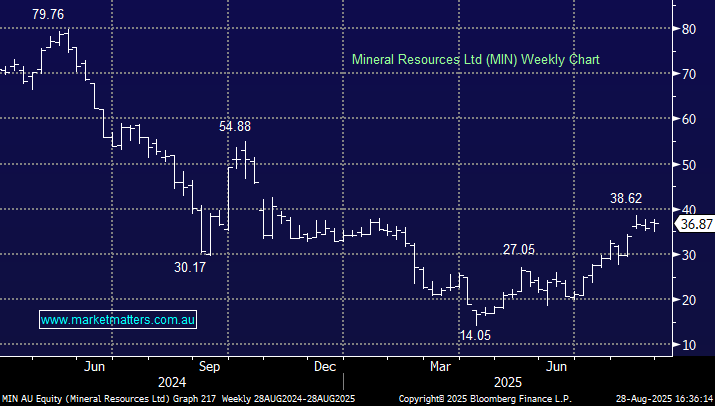

MIN -1.55%: Reported its FY25 numbers on an overall weak day for iron ore stocks and especially lithium names with IGO Ltd (IGO) -4.67%, and Lion town (LTR) -3.8%.

- FY25 revenue came in at $4.47bn down 15.3% YoY, from $5.28bn, estimates were for $44.45bn.

- FY25 underlying loss of $112mn compared to a profit of $158mn YoY, better than the expected $250.3mn loss.

- EBITDA came in at $901mn, down 15% YoY, better than the estimated $833.5mn.

The company said its immediate focus is on strengthening the balance sheet which has been a key focus for the market over the last 12 months. Interestingly from a timing perspective UBS lifted its spodumene price forecast, citing operations for Chinese supply disruptions saying the market could be almost in deficit by 2026.