This Sydney-based global medical diagnostics company operates one of the world’s largest networks of pathology labs, imaging/radiology services, and primary care clinics across Australia, the US, and Europe. Its “federated model” lets local brands run independently while benefiting from the scale and expertise of the wider group – such as Douglass Hanly Moir Pathology in NSW and Melbourne Pathology in Victoria. They missed the mark in a major way last week with their FY25 numbers and more importantly FY26 guidance sending the stock plunging almost 20% over a few sessions as downgrades flowed. FY25 Snapshot:

- Revenue of $9.65bn, +8% YoY, just below $9.69bn estimate.

- Ebitda $1.72bn, +8% YoY, slightly below estimates of $1.75bn.

- NPAT $513.6mn, up 7% YoY, below $526.1mn estimates.

The Radiology division stood out with robust growth, achieving 10% organic revenue and 12% earnings growth. The US business faced headwinds but returned to positive organic growth in July 2025; we’re not getting many positive reads on the US economy from the local reporting season. However, it was the release of its earnings guidance for FY26, which fell well short of expectations. SHL guided to Ebitda of $1.87-1.95bn after FX swings, below consensus of $1.98bn.

- This guidance implies a net profit of $583mn, which is 13% growth, BUT a painful 9% downgrade to market expectations.

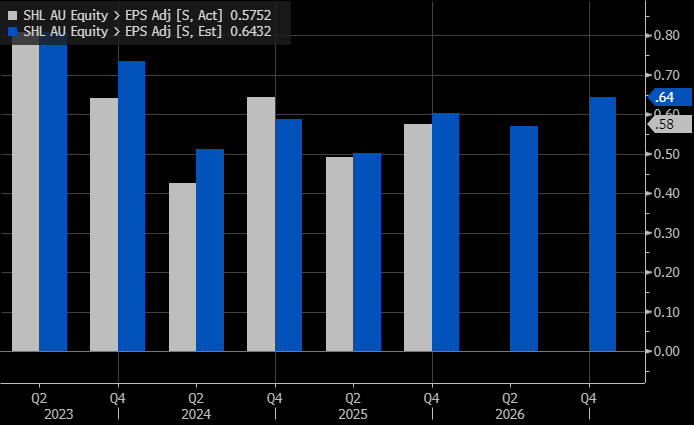

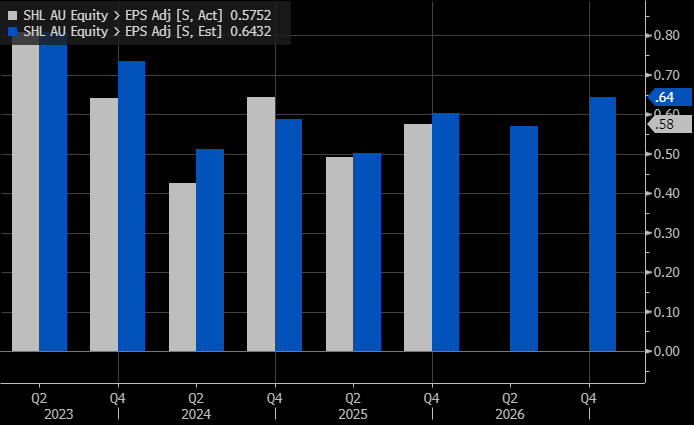

With SHL guiding to an uninspiring and disappointing FY26, we must consider whether to remove it from our “Hitlist.” Downgrades flowed as would be expected after a 9% “miss,” although all remain well above yesterday’s closing level. The mean target price is still above $28, as can be seen on the MM Site. Our concern is that SHL are struggling to deliver organic growth from their overall business: SHL has spent $3.3bn on acquisitions since FY19, yet its EPS has not improved. The synergy benefits from these transactions have been mainly offset by factors such as labour costs, price cutting, and rent.

Even as SHL tests multi-year lows its hard to see confidence returning until we hear better news on the growth front, although its trading on the cheap side of the ledger and is forecast to yield more than 4.5% over the next 12 months. Despite revenue growth, higher labour and inflationary costs have eroded margins, however, efficiency gains through AI and genetic testing could deliver improvements on this front in the years ahead – this could be the key to if/when MM will reconsider SHL.

Moving forward SHL’s growth will be driven by steady demand for pathology and imaging services, underpinned by ageing populations and rising chronic disease rates. Profitability should improve through lab automation, AI adoption, and efficiency programs, with margins likely to gradually recover over the next few years. The problem is that while SHL is a solid business, its latest miss may take a while to undo, especially from a sentiment perspective; there’s no compelling reason to hold the stock at this stage.

We still believe SHL is a solid business, but have removed it from our Hitlist, seeing better opportunities elsewhere.