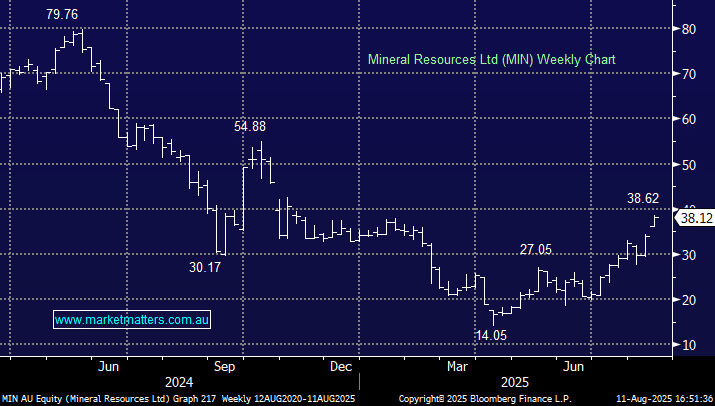

There has been a lot going on with MIN in recent times from a “billionaire behaving badly”, to questionable roads and depressed iron ore and lithium prices. However, we have started to see improvements from most of these metrics and the stock has more than doubled from its April low. Mineral Resources’ diversified business model, including its Mining Services and iron ore operations, ensures that the company remains committed to long-term growth. The Onslow Iron project is expected to be a significant contributor once fully operational. MIN is a relatively high-cost lithium producer, but as lithium and iron firm, it will be in a position to pay down debt levels that have concerned investors and attracted the shorts. This makes it a leveraged play on both commodities, and higher prices for both will help them repair the balance sheet – a key concern from the market.

Given the strong share price move, we would not be surprised if MIN pressed the button on an equity raise, which would be at a decent discount. While this would generally be negative in the short term, we do think the balance sheet is holding plenty of investors back, and a raise could address that issue.

- We can see MIN testing the $50 area into 2026, another 25% higher: MM owns MIN in its Active Growth Portfolio.