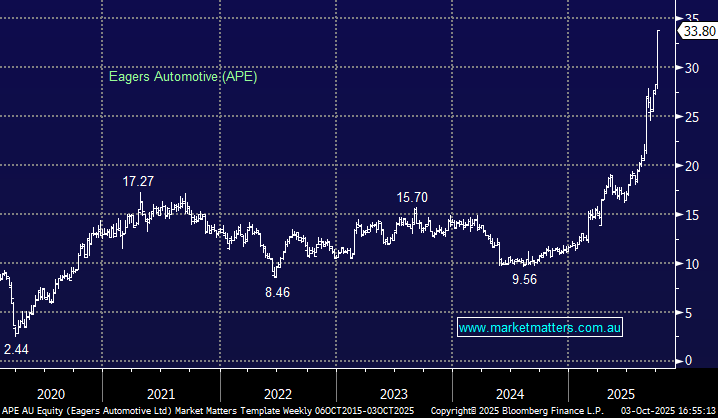

MIN +2.26%: posted a strong operational finish to FY25 with some key positives across all 3 areas of their business, while their financial metrics (debt) showed signs of improvement.

- Onslow Iron continues to ramp-up, posting a June month exit run rate of 32.4Mt (100%) basis, relative to nameplate capacity of 34Mt – this was really important as the market remains highly skeptical of their ability to ramp up to this level.

- Mining services volumes were 280Mt, up 11Mt YoY, but at the lower end of the guidance range (280-300Mt).

- The Lithium segment saw sales broadly in-line with expectations; however, Wodigna realised pricing and costs were better than expected.

The balance sheet and liquidity is the key concern here, and while debt remains very high at $5.3bn, this was better than expected of $5.5b, and they have available liquidity of $1.1bn.

This was a good update, and one that showed positive progress in key areas. They still need Iron Ore prices to ideally stay above $100/mt and some ongoing recovery in Lithium would help, but they’re addressing their issues and making progress, with the Haul Road upgrade on track for completion this quarter.