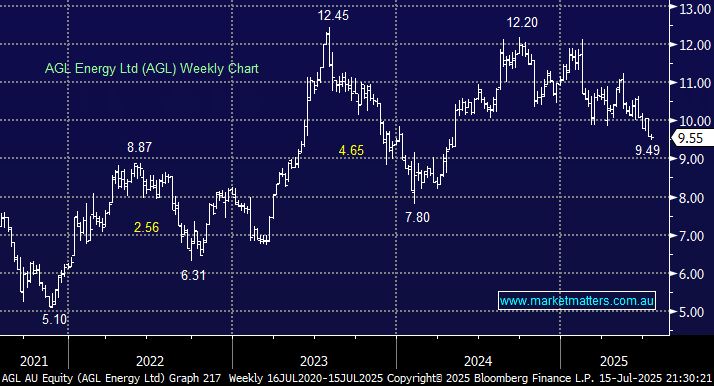

AGL has been an underperformer in the Income Portfolio this year, following a solid 1H25 result in February, with underlying earnings around 8% ahead of consensus expectations at the time. However, their guidance for the full year implied a weaker 2H due to lower seasonal demand and increasing customer competition. There have not been any meaningful changes to earnings forecasts in the back end of the year, and if anything, there were slight revisions higher in February, but the stock has been on a consistent drift lower. We originally bought the position well, under $7 in early 2023, adding at higher prices around 6 months later. The stock ran to $12 but is now back sub $10 and looks weak.

- While our position is still up 37%, the AGL share price has come off the boil.

FY24 was a very strong year for earnings growth, with a big (+250%) bump up from weakness in FY23, and we expect FY25 earnings to be down YoY. There are challenges in a business like this transitioning from fossil fuels to clean energy, with a lot of money to spend to make it happen. To date, we think AGL have handled the balance well but the market has been in and out of love with this story, pushing the stock in a broad valuation range, from a PE high of 17x to a PE low of 8x since 2020. AGL now sits more than 1 standard deviation below the 12.3x it usually trades on, implying there is a relatively high degree of concern attached to their upcoming results next month.

On a single digit PE (9x) and a projected 5% yield, there is not a lot of optimism baked in, and Origin (ORG) may be partially to blame for some of the performance having announced a very positive piece of news around the valuation of an asset, which has seen money flow into ORG pushing it from below 12x to now above 18x.

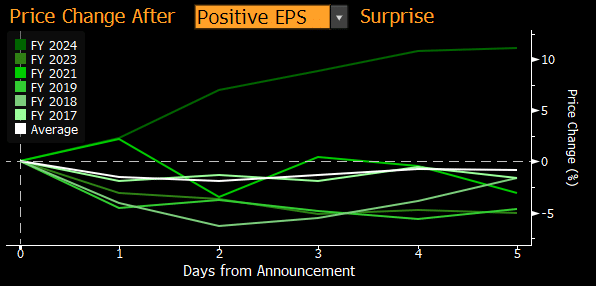

While we think AGL screens on the cheap side of history, and the yield is attractive, they do have a history of underperformance even after an earnings beat, as the chart shows. This is because they generally provide more downbeat guidance or commentary even after beating – it’s a hard sector they operate in!

Of the six times they’ve beaten earnings since 2017, only once has there been a subsequent strong rally in the shares (FY24). They’ve missed twice in that time frame (FY20 & 22), and the average decline is 6%.

Ultimately, while we see value in AGL and remain comfortable with the position’s yield for this portfolio, holding for results has more often than not detracted from returns. We have removed the ‘Active’ tag from the position, implying we are not buyers ahead of the 13th August FY25 result.