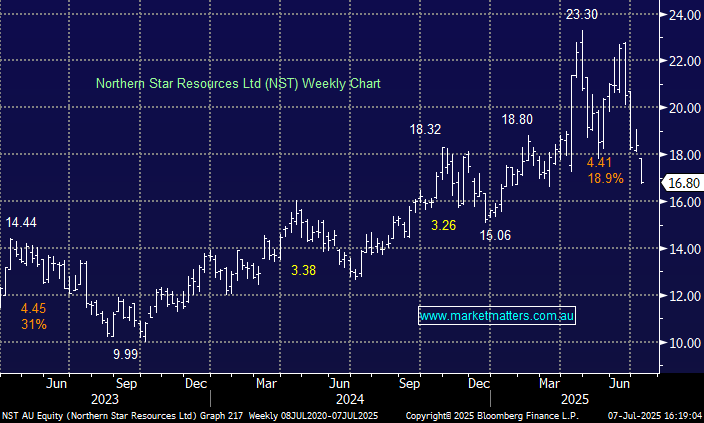

NST –8.65%%: FY26 guidance and Q4 production numbers came in slightly below consensus while cost guidance was revised higher with All-in Sustaining Costs (AISC) ~5% above expectations.

- FY25 gold sold to 1,634koz, at the lower end of the revised group guidance range of 1,630-1,660koz

- FY26 production guidance of 1700-1850koz, around the midpoint of consensus ~1,811koz

- FY26 AISC increased to $2300-2500/oz and growth capex +~$400m higher than consensus of ~$1.7 billion

This is another recent example of NST delivering softer production as they work through more challenging geology. While NST is not out preferred Gold exposure, we do remain bullish on the gold sector overall into current weakness. Our preference is for Evolution (EVN).