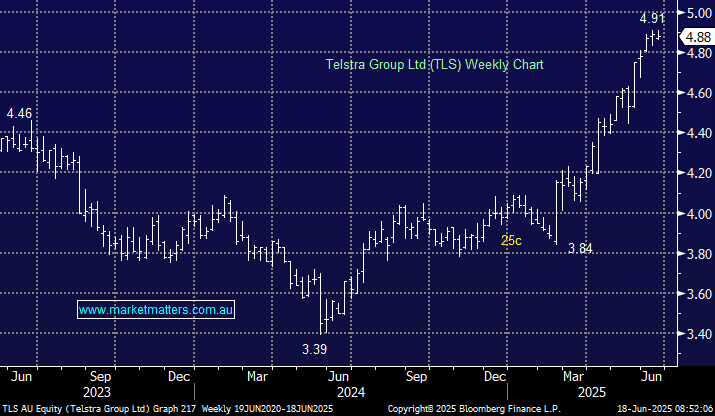

We’ve written about TLS several times in recent weeks as the stock has rallied, concluding that we like the direction of the telco over the coming years, believing that it affords a solid combination of modest earnings growth, a reasonable yield, supported by ongoing share buy-backs. The only issue we have currently, is valuation as it knocks on the door of $5.

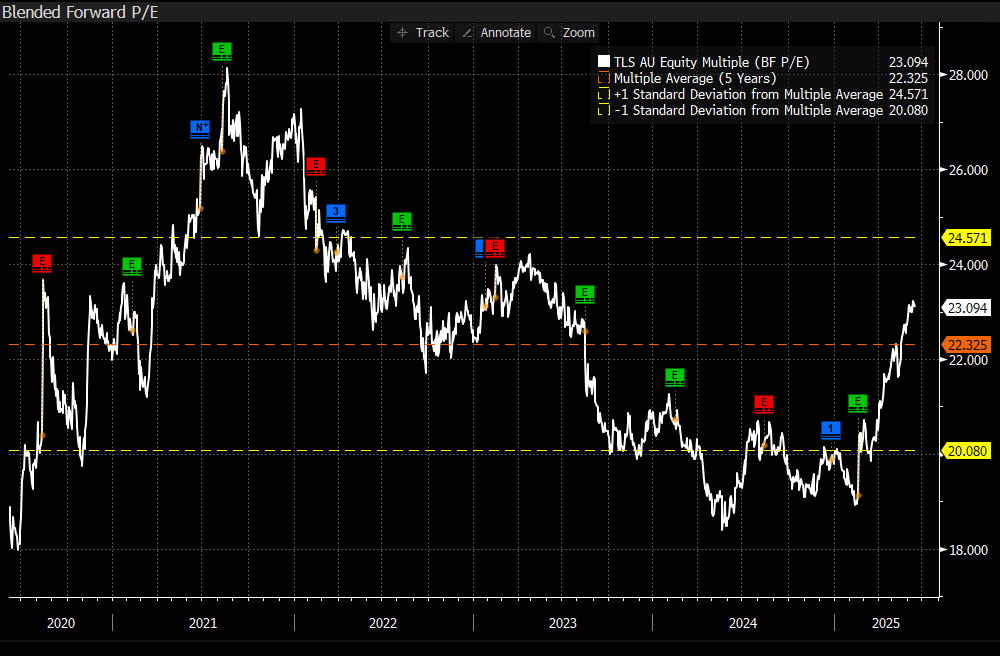

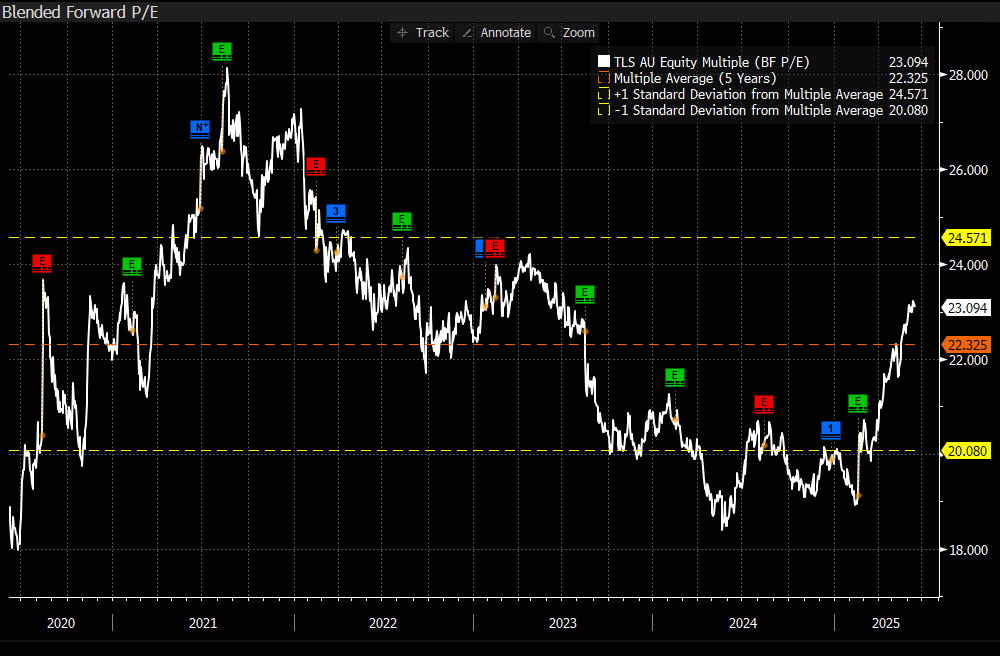

Between 2021 and 2024, the TLS share price remained stagnant, despite growing earnings, which led to a material decline in the earnings multiple (PE), as shown in the chart below. That highlights a degree of market pessimism/scepticism that lasted 3 years; however, we now see the market is prepared to pay a higher multiple for earnings, underpinning a good move higher in the share price. While TLS is not extremely expensive, trading on 23x FY26 earnings, market optimism has clearly firmed.

TLS is now at forefront of technology in its space, having just announced it’s the first local telecom provider to enable customers to send and receive text messages in areas without mobile service, through its partnership with Elon Musk’s SpaceX and his Starlink satellites. This represents a significant step forward for individuals in remote and regional areas where mobile reception is limited. We have no doubt the competition will follow soon, but this is a case in point that the fresh TLS is evolving from the sleepy telco behemoth of old.

- That said, everything has a price, and as pessimism has now turned into optimism, we are considering taking what is potentially an unpopular decision to realise profits in the Income Portfolio to target more interesting income focussed opportunities.