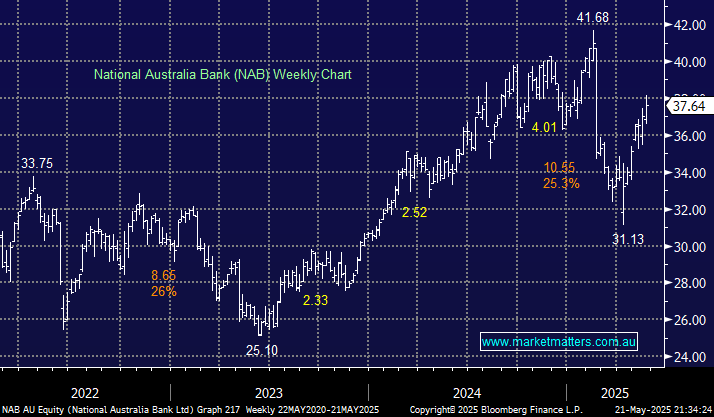

NAB experienced the sharpest correction amongst the “Big Four” traditional banks following Liberation day, demonstrating its relatively high Beta amongst its peers. NAB’s 1H FY25 result was broadly in line with estimates aided by a lower-than-expected credit impairment charge. With no surprises now expected this year NAB will trade around what valuation the markets prepared to attribute towards the stock and sector – this is not our preferred local bank, but we still think it represents good value into pullbacks.

- We can see NAB making new highs into Christmas, or about 12% higher.