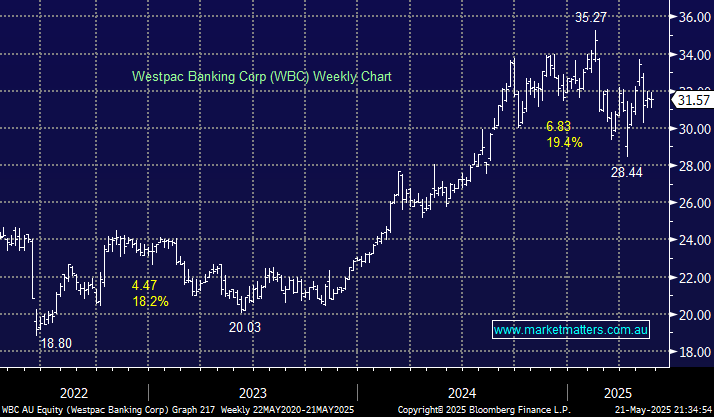

WBC was the most stoic of its peers during Aprils sell-off although it was still ugly as was the case across most sectors. The bank disappointed a tad earlier this month with its 1H25 result due to a headline miss on profit and slight net interest margin (NIM) but follow through selling hasn’t materialised. The story is very similar with WBC to the previous three banks with again its more than 5% yield likely to prove supportive into dips, as they progress with an aggressive cost reduction strategy.

- We are targeting the $36 area for WBC through 2025, or ~12% higher : MM holds WBC in its Active Growth Portfolio.