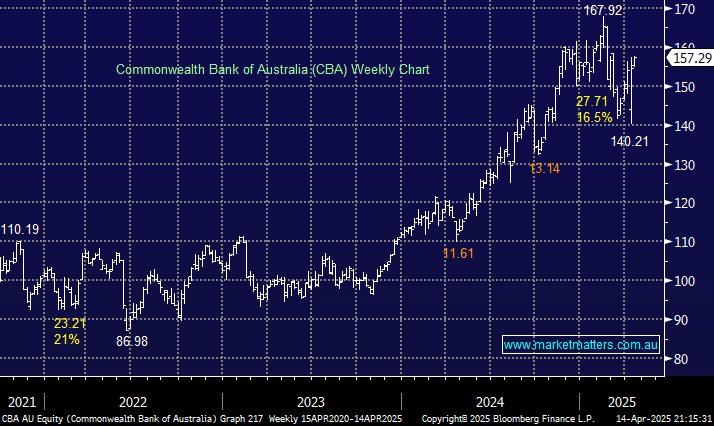

So little needs to be said about CBA, it’s a great bank, priced “richly” for a reason. It’s undoubtedly expensive on all traditional metrics, but it has proven capable of adding value to a portfolio as both a defensive play and a relatively high beta stock when the market is on fire. This a great example of not “fighting the tape”, and although a forecasted fully franked yield of ~3% isn’t as compelling as its peers, we wouldn’t be betting against it i.e going short as a trader. CBA is set to report and trade ex-dividend in August.

- We can see CBA defying its sceptics and making new highs in 2025: We own CBA in our Active Income Portfolio.