- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

A very solid bounce back on the ASX today with ~85% of the main board finishing higher. Risk was back on with technology + market linked stocks leading the way, though resources lagged. The US Fed kept rates on hold overnight as expected, however they upped their inflation forecasts but downgraded growth expectations, which is net/net neutral for interest rates which we think still go lower between now and year end.

Locally, employment data was softer than expected today, weak participation offset a large reduction in the number of jobs created (-52.8k) to keep the unemployment rate steady at 4.1%. It was a soft number which saw bond yields lower, Aussie 2’s down 5bps to 3.73% and the prospect of lower rates got equities humming. The prospect of a May cut increased to ~80% with a 100% probability of a cut priced in by early July.

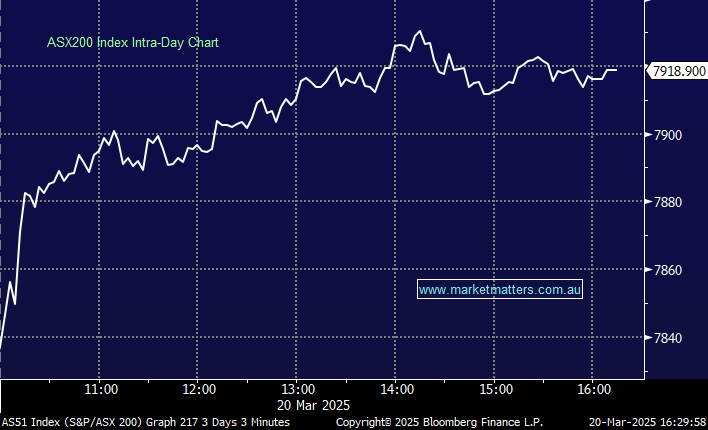

- The ASX200 rose +90pts/+1.16% closing at 7918

- IT (+2.42%), Real Estate (+2.06%) and Financials (+1.86%) in the winners circle.

- Materials (-0.63%) and Utilities (-0.19%) the only two sectors lower.

- Banks were solid today as buyers trickled back into the market, Macquarie (MQG) +3.81% led the line supported by Commonwealth Bank (CBA) +2.21%

- NAB +1.35% has been the recent underperformer of the big 4 recently, the bank we like least given rising competitive pressures in business banking, though it has pulled back ~23%.

- NRW Holdings (NWH) +3.23% landed a 12-month $100m contract with Rio Tinto (RIO) -1.01% for procurement and construction works at Rio’s Dampier desalination project in the Pilbara W.A.

- TPG Telecom (TPG) +5.93% jumped on news the competition and consumer regulator waived through the $5.25 billion sale of its fibre networks to Vocus Group.

- Sigma Healthcare (SIG) was flat after disappointing on its final standalone full-year result prior to the merger with Chemist Warehouse.

- Nanosonics (NAN) +13.96% jumped as U.S regulators approved their Coris system designed to clean endoscopes.

- Cleanaway Waste Management (CWY) +1.96% traded up announcing the acquisition of Contract Resources for $377m, targeting $12m of cost synergies annually.

- Ampol (ALD) +2.51% announced the disposal of their 12.67% shareholding in New-Zealand-listed infrastructure group Channel for ~$A85 million.

- Gold was flat during the session, trading around $US3049/oz at our close, holding around all-time highs.

- Mixed trading in Asia, Hong Kong down 1.2%, China flat while Japan was trading 0.30% higher

- Iron Ore in Singapore was lower, dipping below $US100/MT