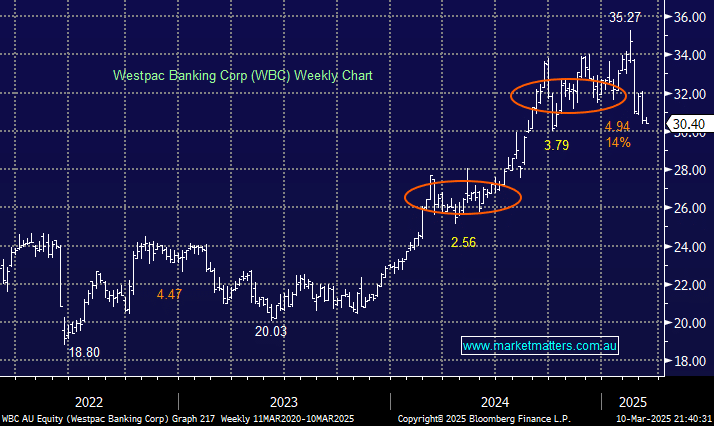

After correcting 14% in a few weeks, WBC has become far more palatable from a valuation perspective, though it’s still not ‘cheap’ relative to historical metrics. The bank is forecast to yield 5.3% fully franked over the next 12 months, with its first appetising dividend paid in May. Hence, it wouldn’t surprise many to know that April is seasonally a strong time for ASX banks, as is July, when the dividends hit investors’ bank accounts.

- We like the risk/reward toward WBC under $30, we may tweak our 5% position to 6%, the same position size as our ANZ holding – MM holds WBC in our Active Growth Portfolio.