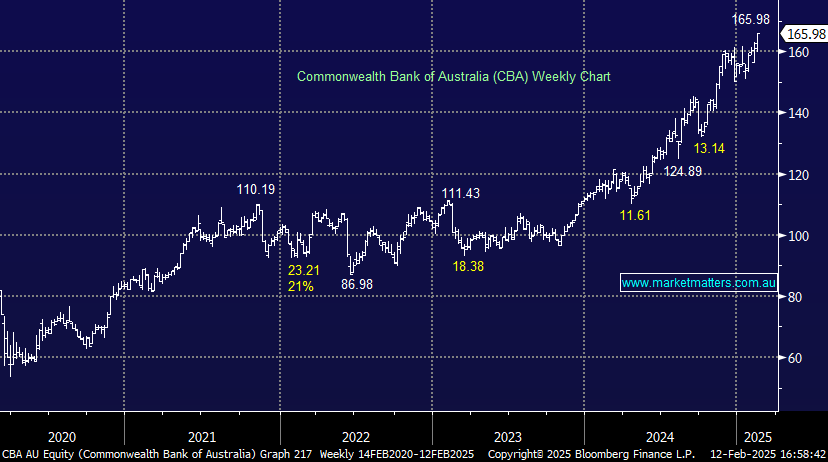

CBA +2.36% delivered another very clean and solid result under CEO Matt Comyn, showing why it remains top of the pile of Australian and even global banks. Cash earnings a touch ahead of expectations, a bump higher in the dividend, very strong asset quality, expansion in margins, and a likely upcoming tailwind from interest rate cuts which should boost confidence and therefore lending volumes – the story remains a good one for CBA, and the stock was pushed to new all-time highs as a consequence;

- Revenue of $14.10 billion, up +3.8% for the year.

- Cash profit of $5.13 billion, up 7.9% YoY and ahead of estimates for $5.09 billion

- Net interest margin 2.08%, higher that expectations for 2.03%.

- Operating expenses on cash basis $6.37 billion up +6% YoY and higher than expected.

- 1H25 dividend of $2.25 FF, above $2.19 expected

Very hard to fault the result, even the higher-than-expected expense line is a result of investment in things like AI, and we’ve seen over time how such investments drive better operational and financial performance.

In terms of economic commentary, they said things had slowed considerably, with cost of living pressures continuing to weigh on consumer demand and younger customers in particular making real sacrifices. They talked to weak private sector growth, immigration starting to slow and geopolitical uncertainties that remains remain. On a more positive note, underlying inflation is now moderating towards the target range and they expect rate cuts despite the strong labor market and level of ongoing public sector infrastructure spend which provides cause for optimism on the domestic economic outlook.

- A solid/good result from CBA today, hitting all the high notes and supporting the shares to new highs, after initially trading lower. Matt Comyn did a good job on the conference call.