TLS delivered a solid FY24 report in August and a mild upgrade to FY25 earnings guidance, helped by price increases across its mobile services, a consumer staple these days. The leading Australian telco has embarked on huge job cuts, with 2,800 announced in May, to lift profits—great for shareholders but, as we found, not service. The telco confirmed in August that it scrapped plans to create an energy business selling power plans as it focuses on its proverbial knitting. CEO Ms Brady has TLS looking at its more profitable companies, mobile phone plans and InfraCo, which owns data centres and telephone poles, plus subsea and fibre-optic cables with a 9-10% employee cut, helping drive efficiencies.

NB Our experiences did show that TLS is the first company we’ve heard of that allows users to speak to an overseas call centre immediately or hold for an Australian-domiciled service person. Perhaps they are listening to some people’s needs, while also being pressured by the likes of Aussie Broadband (ABB) who have local support.

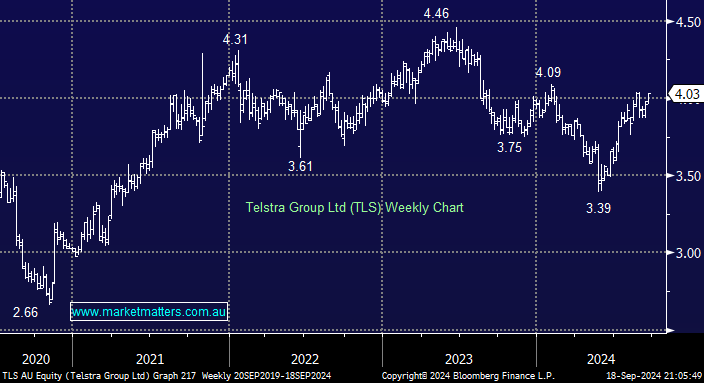

- Frustrations aside, we like TLS around $4 and believe the next 10-15% is one of the upsides – MM owns TLS in our Active Income Portfolio.