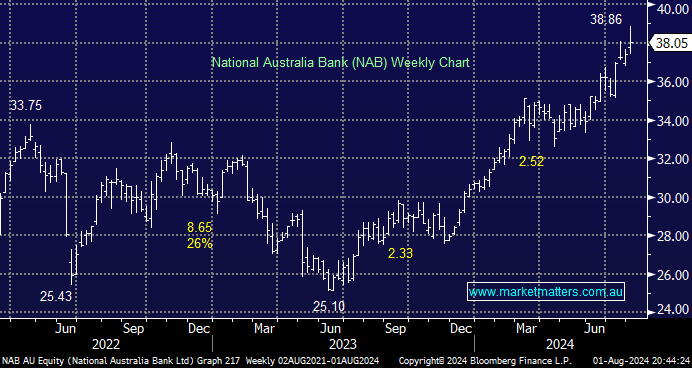

NAB has rallied ~24% so far in 2024, plus it paid an 84c fully franked dividend in May. Following a question on the banks, we discussed NAB in Thursday’s webinar, and it looked like the market was listening to James, who felt NAB was losing its lustre after rallying more than 50% from its June 2023 lows, i.e. NAB retreated over 2% from its intraday high. While we aren’t reading too much into a session that saw a few outperformers encounter some profit-taking, we did raise one concern towards NAB that MM will watch and evaluate moving forward – business banking has been the jewel in NAB’s crown since we can remember, but CBA, in particular, is now making meaningful inroads into the space. For example, WBC and CBA accounted for 52% of net new business lending in June as their penetration into the area gathered momentum. Also, CBA and WBC dominated the business-driven increase in deposit growth over the month.

- We might tweak our bank exposure, away from NAB, moving forward – MM is long NAB in our Active Growth and Active Income Portfolios.