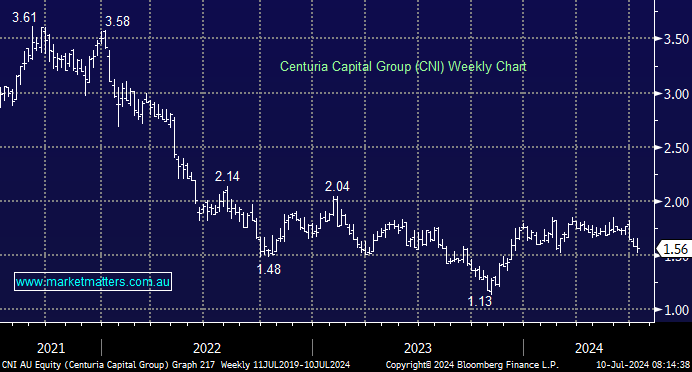

Early in the week, UBS re-cut their numbers on the local property stocks, and with that, they downgraded CNI to sell – should we be concerned? The list of downgrades included cutting CNI/GMG/SCG from Neutral to Sell and ARF/BWP from Buy to Neutral. The view is a call on interest rates staying higher for longer, with the more leveraged property companies like CNI and SCG struggling to grow in that environment (while their call on GMG was around valuation). On the flipside, they recently upgraded Mirvac (MGR) to buy and Lendlease (LLC) and Vicinity (VCX) to Neutral from Sell. Their preferred sector calls are Dexus (DXS), Mirvac (MGR) and Region RE (RGN). This is a call on relative performance, with CNI down 1.4% for the year relative to LLC down 25.1% and Mirvac (MGR) down 15.8% (as at 5th July).

The changes are also underpinned by a rejigged forecast on interest rates, with UBS now forecasting two +25bps interest rate rises over the next 12 months. This is an aggressive call, not currently priced into markets and is more hawkish than many others That naturally has a bigger impact on the companies carrying higher debt, and a lower impact on the companies carrying lower debt. In the case of CNI, it also impacts their ability to raise new money from retail investors which is important for their growth in FUM and therefore earnings. The other side of this, is around their ability to take advantage of weakness. Ideally, when asset prices fall, it creates opportunities for those with enough balance sheet flexibility to take advantage of the declines to generate longer-term value.

- Our positions in CNI (across the Income & Emerging companies portfolio) are underpinned by our view on interest rates. We ultimately believe the RBA will not raise rates, and in that environment, the more leveraged stocks to rates will outperform those with less leverage to rates.

While we think UBS raised some solid points, and there has been some considerable variation in performance across the sector, highlighted at the extremes in the past year by Goodman (GMG) +76% and Lend lease -25%, we believe it’s the wrong time to be moving against the leveraged companies. That said, we are balancing exposures in the two portfolios that hold CNI, with positions in National Storage (NSR) in the Income Portfolio, and BWP Trust (BWP) in the Emerging Companies Portfolio, while in the Growth Portfolio, we hold GMG & NSR.

- On balance, we remain comfortable with our property exposures across the suite of MM portfolios.