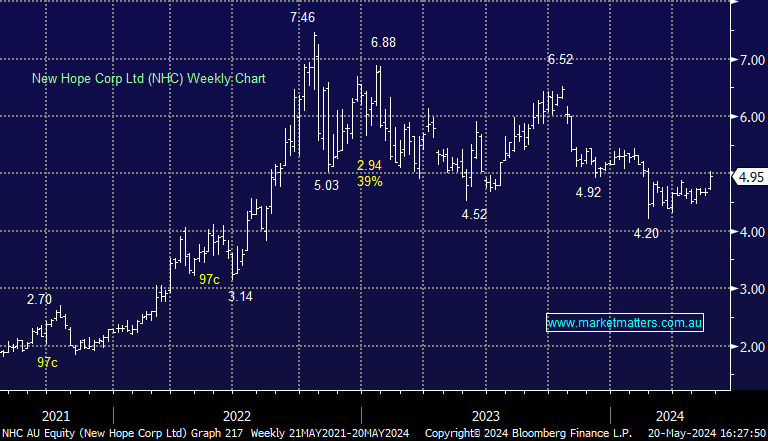

NHC +5.77%: 3rd quarter sales update out for the Australian coal company today were better than expected with strong production growth heading into the end of the year. The company produced 2.5Mt of coal in the quarter, up 21% from 2Q while costs tracked lower as a result of the increase. Their main asset, Bengalla in NSW, has produced 15% more saleable coal in the 9 months to April vs the same period last year while costs fell to $73.4/t last quarter. Their new Queensland mine, New Acland, has performed well while ramping up production and the company increased sales guidance for the mine from 0.66Mt to 0.8Mt for FY24 supported by additional rail capacity. On the back of the solid production, New Hope saw EBITDA off $219m, up 21.6% on 2Q, ending the period with $381m in cash.

- Strong production and balance sheet, we own NHC in the Active Income Portfolio