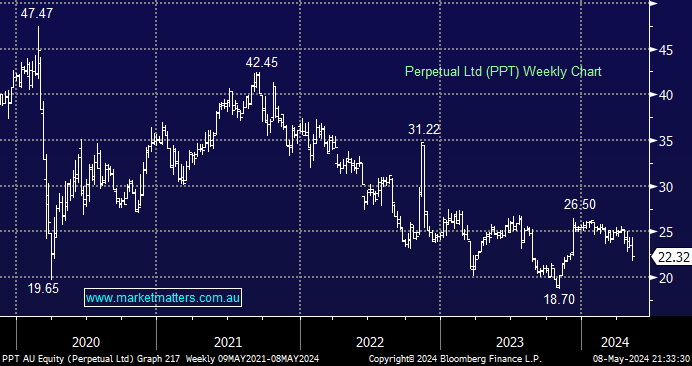

A lot has been written about PPT by both MM and the larger media in general; hence, we won’t regurgitate the full story again, but below are a couple of salient points relevant to the current play.

- Although the price/deal looks reasonable, shareholders still have many questions about how much of that price will be realized.

- Questions remain about how debt and tax will be dealt with. In a full liability situation, the deal could see $500m in tax owing.

- Our conclusion was easy: We see no reason to invest in PPT; it’s in our “too hard” basket.

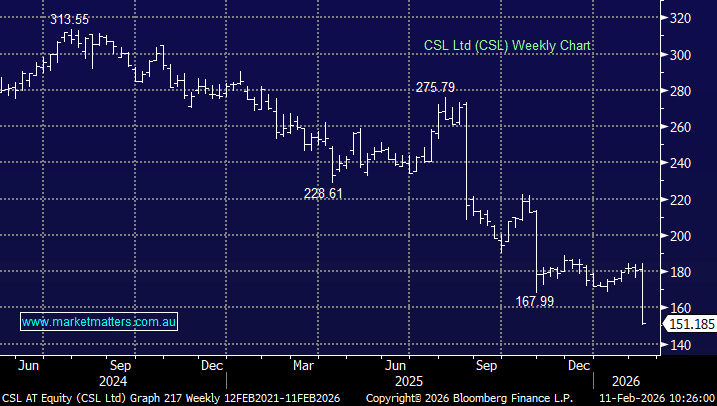

This morning, we updated our view on four of the ASX fund managers who remain on the ASX, perfectly illustrating that not all ships will float as one.

- Remember MM is bullish towards equities over the next 12-18 months, which should provide a tailwind for the sector.