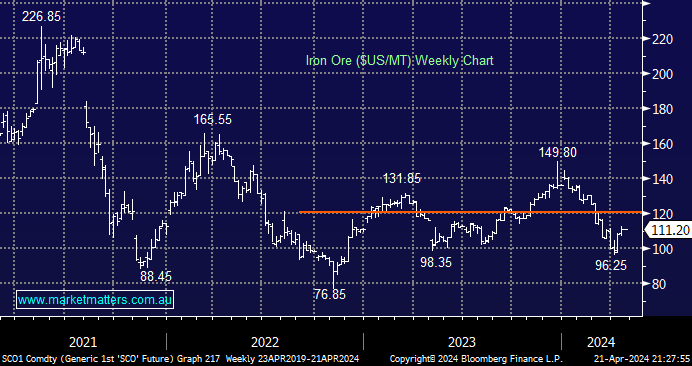

Iron ore has bounced over the last fortnight, enabling Rio Tinto (RIO), for example, to bounce over 8% in a weak market, illustrating that investors have positioned themselves for lower prices of the bulk commodity. With China showing signs of improvement in its embattled economy, we can see further upside in China-facing commodities and stocks.

- We believe the risk/reward favours exposure to iron ore on dips to around the $US100/MT area.

Dr Copper is often regarded as an excellent indicator of future economic strength, and recent gains suggest the markets are seeing signs of economic pick-up in China. However, it’s not all good news, with a strong copper price historically correlated to rising inflation, or in the current case, “sticky” inflation. Crude oil is far more influential on inflation than copper, but the industrial metal does suggest that rate cuts are likely to be slow and steady through 2024/5, as opposed to being aggressive as was the ascent.

- We are bullish on copper, with last week’s strong move on track to eventually take the industrial metal towards the psychological $US500 area.