The ASX200 started to unwind last week, taking its recent pullback to more than 5%; it felt far worse into Friday lunchtime. Capitulation-like selling washed through the ASX at the end of last week as we heard that Israel had launched attacks on Iran. However, ironically, crude oil finished the week noticeably lower, and gold failed to make new highs, implying plenty of the Middle East news is already built into markets. MM took advantage of the aggressive selling to purchase CAR Group (CAR) for our Active Growth Portfolio, a stock we’ve flagged over recent reports. We remain in “Buy Mode” although our cash levels aren’t as high as they were, although they are almost double the average US fund manager.

- The SPI Futures are pointing to a +0.4% advance this morning after the strong performance by the Resources and Financials on Friday night, i.e. the ASX is not a tech index

US equities continued to struggle last week as the macro headwinds picked up momentum just after fund managers almost went “all-in”. The four headwinds are similar to last week, but come Friday, they we’re feeling more of an issue:

- Middle East tensions have been steadily increasing through 2024, dragging the oil price higher and increasing fears that inflation will remain “sticky”.

- Markets now doubt the Fed can/will deliver two rate cuts in 2024, especially now their dovish rhetoric has dissipated.

- Earnings season is upon us, which means buybacks are on the sidelines, and Big Tech needs to deliver to meet lofty expectations.

- The seasonal “sell in May & go away” period is approaching fast, just when some investors are looking for an excuse to adopt a defensive stance.

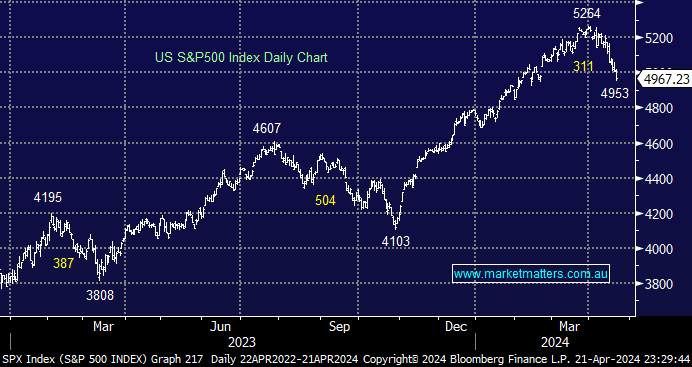

We like the risk/reward towards the S&P500 as the index dips below the psychological 5000 level:

- The US S&P500 has corrected ~5.9% from its recent all-time high; another few percent cannot be discounted but we aren’t turning overly bearish at this stage.

The weak Yen, which helped push Japanese stocks to all-time highs last month, continues to struggle, but the macro backdrop appeared to get the better of the bulls last week and its quickly corrected 10.6%. We continue to like the Nikkei into weakness, but it’s not for the fainthearted.

- We have been targeting a pullback for the high-flying Nikkei. It’s slipped further than we anticipated, but we for now like the index around 37,000.