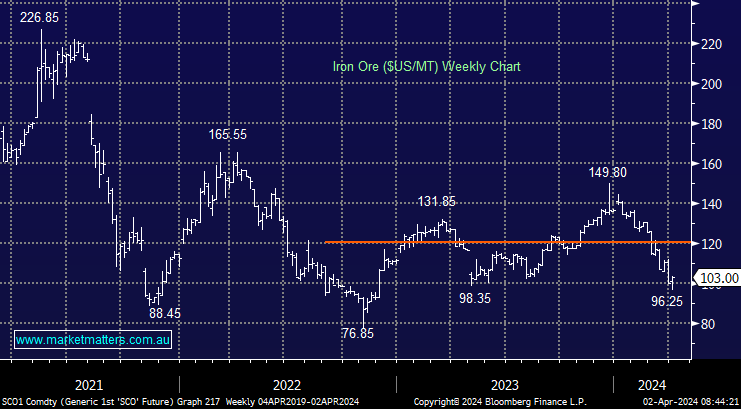

Iron ore bounced overnight after posting a fresh 10-month low over the long weekend after the China Iron and Steel Association warned last week that China’s property crisis and relatively weak infrastructure development were delaying a recovery in demand. Clearly, this is not good news, but the sort of comments which often create a swing low, especially after a more than 30% decline.

- We think there is a good chance the bulk commodity has seen the low of its trading range for 2024, with a bounce back toward ~$US120 being our preferred scenario.

Copper still looks poised to “pop” on the upside, but for now, the “three steps forward and two steps back” dance that has characterised many markets in 2024 remains in play. China remains the key for copper, and yesterday’s strong PMI would have restored a little confidence in their beleaguered economy. While the industrial metal has been comfortable around current levels for a few years, we would be an extremely nervous short at this stage of the cycle.

- We are bullish on copper, encouraged by its firm performance in the face of recent economic headwinds out of China.