The ASX200 is set to open firmly this morning, following in the footsteps of a solid session on Wall Street, which saw 10 out of the 11 major sectors close higher. With the miners enjoying a firm bid on Friday in Europe and the US, we could see the ASX outperform the US, especially as the Tech Sector is starting to look tired, e.g. although the NASDAQ closed up +0.3%, the majority of the “Magnificent Seven” actually ended lower. The “Christmas Rally” doesn’t usually gather momentum until the 2nd half of the month as significant dividends start hitting investors’ accounts; hence, any advance over the next 1-2 weeks could be interpreted as a bonus by the bulls.

- The SPI Futures are pointing to a strong opening this morning, up around 65 points, with gains likely to be led by the Resources Sector, e.g. BHP Group (BHP) closed up 80c, or +1.8%, in the US.

- If the historically more robust December matches November, the index will test the July 7475 swing high.

US stocks closed firmly higher, with major indices advancing for a 5th straight week, enabling the S&P500 to sign off from November with an impressive 8.92% gain, one of the best in the last century. MM believes global and US stocks can maintain their upside momentum into 2024. However, we might be looking to de-risk slightly if we see a classic squeeze into Christmas, I.e. a move that’s usually driven by an absence of selling as opposed to aggressive buying.

- No change; the FANG+ & NASDAQ Indices followed the MM roadmap to fresh 2023 highs; we are now expecting the broad-based S&P500 & Russell 3000 indices to at least push to new 2023 highs – not far now!

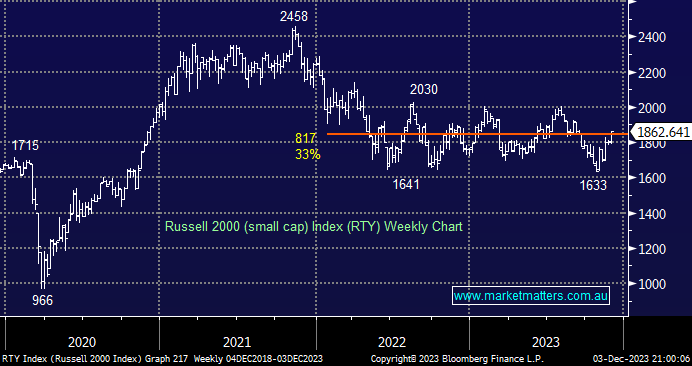

The US small caps outperformed their better-known rivals through November, advancing an impressive +8.8% as the hope of falling interest rates in 2024 was warmly welcomed by the embattled group – even after the recent +14% recovery, the small-cap index is still ~25% below its 2021 high. In contrast, the NASDAQ tech-based index is trading less than 5% below its previous all-time highs.

- We can see the Russell 2000 (small caps) testing the 2000 area into Christmas, or +8% higher.