CSR has recently agreed to acquire Woven Image for A$43m in a move (albeit small) that further extends CSR’s commercial interior offering. It’s a move we like at MM with the attractive multiple explaining CSR’s decision to end its buy-back (with ~$64m remaining) and undertake the acquisition. Overall we prefer exposure to lower-risk US housing end-markets than Australia, but given the better-than-expected start point for building product margins, property earnings support and solid ~5% div yield, we do like CSR.

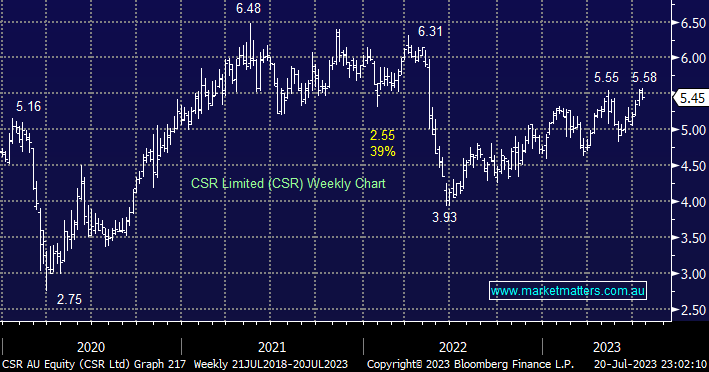

- We will consider CSR into any weakness back towards $5, not an uncommon occurrence!