What Matters Today in Markets: Listen Here each morning

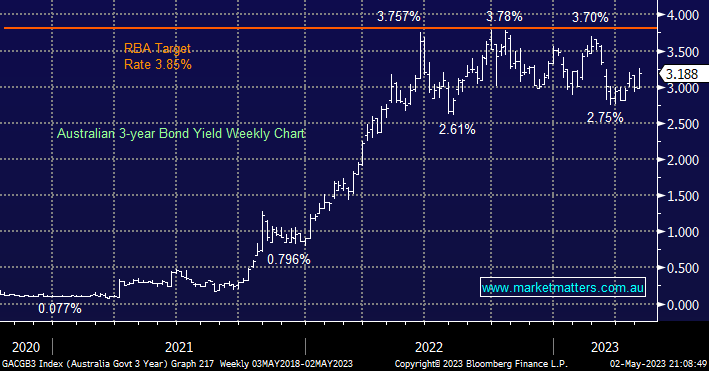

The RBA surprised the vast majority of market participants at 2.30 pm yesterday as they hiked the Official Cash rate from 3.6% to 3.85%, a brutal outcome for homeowners languishing under the mounting pressures of rising mortgage repayments. Our preferred scenario was they would hold at 3.6% until Christmas, that opinion went up in smoke after just one pause in May. The decision by Philip Lowe et al could prove the correct move but it was extremely confusing considering the guidance in the lead-up to Tuesday – they paused in May to watch and consider future economic data, the CPI print came in better than expected and they hike, on this occasion, it’s not surprising that most people called it wrong.

The RBA has been under fire of late as they firstly arguably let the inflation genie out of the lamp by being too timid to start raising rates as prices soared post-COVID only to compound the issue with their worst performance to date, the awful messaging to both financial markets and the press i.e. everyday Australians:

- In late 2021 when rates were at 0.1% Philip Lowe said rates wouldn’t rise until 2024, yet they have now soared from 0.1% to 3.85% in just one year and there are still 7 months left of 2023.

Bill Evans of Westpac is looking for rates to remain on hold for the remainder of this year before rate cuts start to percolate through in Q1 of next year. Potentially our big call was a touch early and after a period of readjustment equities will again start to discount interest rates around 4% as only being troublesome for the highly geared/over-leveraged businesses. However, this assumes that central banks can control inflation without plunging the global economy into a recession.

- We still believe the remainder of 2023 will be fairly quiet on the bond front as investors’ focus swings like a pendulum between inflation and recession fears.

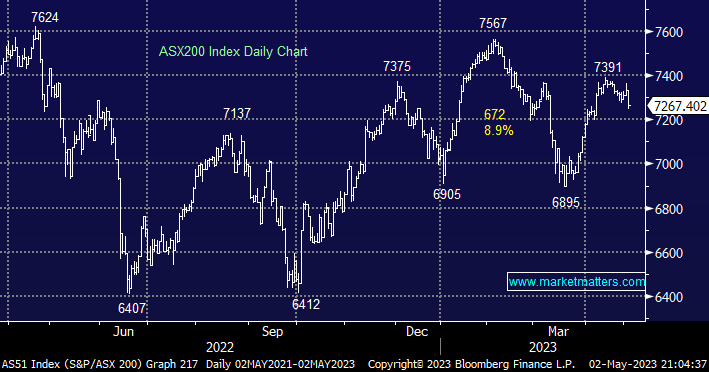

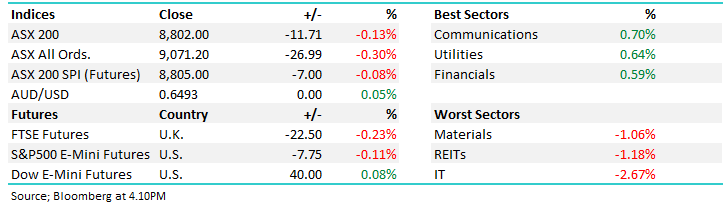

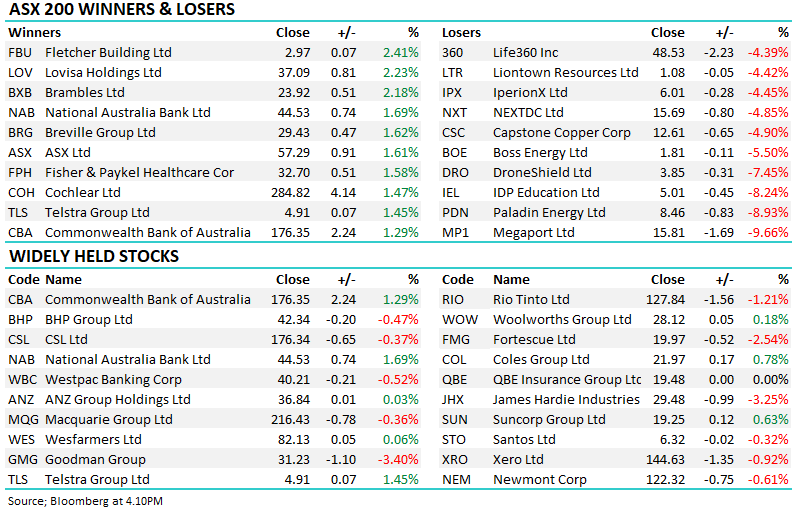

The ASX200 was clobbered -0.9% after the RBA’s move yesterday, not a great backdrop for a market that was already feeling tired. Tuesday’s sell-off felt indiscriminate and futures-led, surprisingly the rate-sensitive names definitely didn’t receive the brunt of the selling with tech the only sector to close in positive territory although real estate stocks did catch my eye closing lower across the board. The next 24-48 hours are likely to provide a better gauge as to what sectors will move both in/out of favour, as opposed to the brief few hours following the announcement, which Philip Lowe said overnight was ‘a very close call’.

- No change, at this stage of the cycle we believe that a neutral stance is prudent i.e. better risk/reward is likely to present itself in the next 1-2 quarters.

After last night’s weakness on Wall Street, the local index is set to open down another -0.6% this morning, if we follow the US the Energy and Financial Sectors are likely to lead the declines.