What Matters Today in Markets: Listen Here each morning

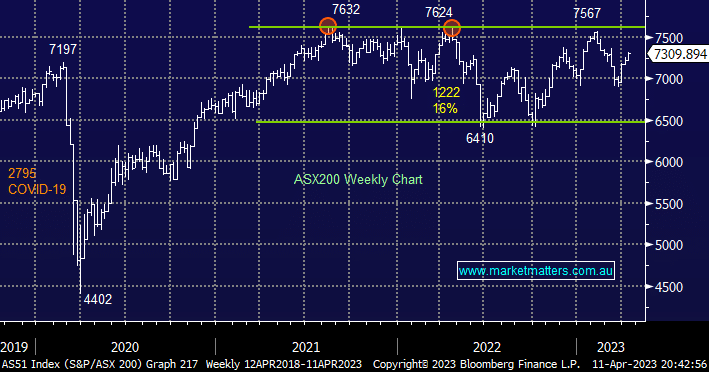

The Australian market stunned a number of followers with its strength on Tuesday but we believe a number of logical factors combined to propel the index to levels not enjoyed by investors since before the banking crisis:

- Investors and traders alike adopted the “if in doubt stay out” approach to the market ahead of the Easter weekend which included the release of the unpredictable but influential US employment data.

- A large number of investors, both retail and professional, have remained comfortable avoiding risk with fund manager cash levels rising from 5.2% to 5.5% in March following the banking ructions.

- Newmont Corp (NEM US) increased its bid for Newcrest Mining (NCM) sending most major miners higher on a euphoric M&A wave e.g. Sandfire (SFR) +6.5%, Evolution Mining (EVN) +3.9%, Mineral Resources (MIN) +3.6% and BHP Group (BHP) +2.1%.

- Lastly some of the technical read-throughs remain supportive of the ASX with the highly correlated European indices nudging all-time highs even after the failure of Credit Suisse.

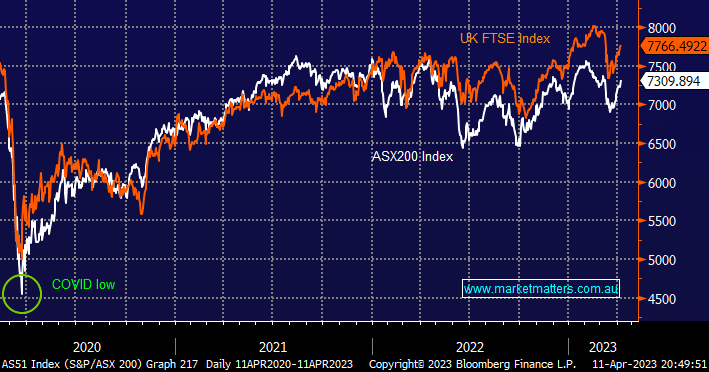

As we often state the ASX moves far more in tandem with the likes of the UK FTSE as opposed to US indices – it’s not rocket science, similar to the Australian market European indices have a larger market weighting of resource stocks as opposed to tech which now dominates most US indices. On the relative performance front, Europe is winning hands down even as war rages in Ukraine e.g. The UK FTSE is less than 2% below its pre-COVID high just above 7900 compared to the US which is -14.5% below its equivalent milestone.

- We continue to believe European indices can post fresh all-time highs in the coming weeks/months.

- As we said in yesterday’s Match Out Report surprises still remain more likely on the upside.

The ASX200 soared +1.3% on Tuesday as it felt like investors were chasing stocks having previously lost confidence in risk assets during the banking crisis in March. Gains were broad-based with over 80% of the index closing in positive territory with standouts led not surprisingly by the miners following Newmont’s revised $29.4bn bid for Newcrest.

Winners: Materials +2.24%, Consumer Discretionary +1.27%, Consumer Staples +1.19%, and Financials +1.15%.

Losers: IT Sector -0.07%.

The performance elastic band had been stretching toward the rate-sensitive names at the expense of stocks most exposed to a global recession, we believe it’s time to consider reweighting back toward value stocks from growth, just as we saw yesterday across the ASX and overnight in the S&P500. This is especially important for MM taking into account our current overweight skew towards tech stocks in our Flagship Growth Portfolio.