What Matters Today in Markets: Listen Here each morning

This time last week the market was abuzz with the previous day’s 10th consecutive interest rate hike by the RBA which in the process took the Australian Official Cash Rate to 3.6%. This morning that’s a distant memory as analysts apply stress tests to the embattled US & Global Banking Sector, the former has already fallen -39% from its January 2022 high – this week we have already seen well know Zurich based merchant bank Credit Suisse (CSGN SW) plumb a fresh all-time low showing it’s not just the vulnerable US regionals that are catching sellers attention.

- MM believes the Fed and President Biden have sent financial markets a clear message that they will not allow any contagion fallout from SVB’s collapse.

However even as calm returned to some pockets of financial markets we still saw follow-through selling from overnight markets cascade through most sectors of the ASX, although the severity was surprising in places on initial inspection:

- Gold stocks advanced which was no surprise after the $US50/Oz rally in the underlying precious metal although we would have expected more than a +0.4% gain from Evolution Mining (EVN).

- The Aussie banks held up remarkably well with CBA closing positive and NAB the worst of the “Big Four” only falling -1.5% – perhaps we have become the safe haven for investment in global banks.

- The Tech Sector ignored a solid NASDAQ and tumbling bond yields to close down -3.4%, we actually expected a positive session but the tech influence from Silicon Valley Bank was clearly the driving force.

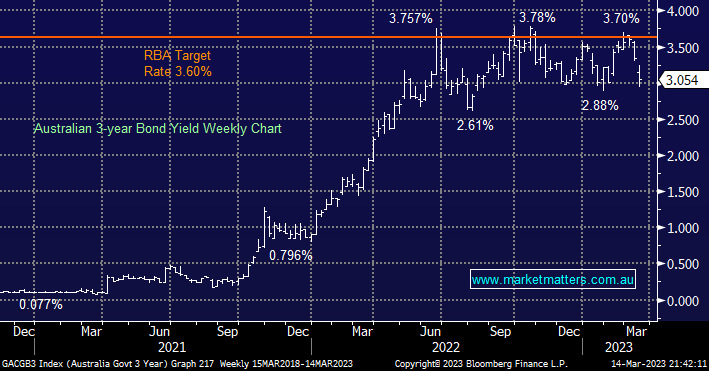

Yesterday saw Australian 3-year bond yields trade below 3% while the cash rate has only just been hiked to 3.6%. We believe the RBA will now sit on its hand for at least a few months but it still feels too early to call for rate cuts in our opinion i.e. at this stage of the cycle we are neutral bonds being a buyer of 3-year yield at 2.75% while a seller around 3.5%.

- Interestingly last week we adopted a contrarian dovish stance toward Australian interest rates & bond yield, we thought “one and done” was the likely path but following the failure of SVB even we might have been too hawkish!

The ASX200 has already fallen -8.2% from its February high and we believe it’s time to slowly start accumulating into weakness although we will remain very stock and sector-specific as another test of 6500 cannot be totally discounted i.e. the markets have already fallen and risen by over 1100-points over the last year, why not one more time. Coming into lunchtime yesterday we were actually down -1.25% for 2023 illustrating the fickle but exciting nature of the market we’re currently navigating i.e. everyone was bullish and optimistic in January!

- We believe the ASX is poised to embrace the fresh rollout of the “Fed Put” making us selective buyers into weakness around 7000.

The US experienced a mixed session overnight with ongoing strength in the Tech Sector combined with a bounce in the Financials partly offset by weakness in the energy names following a sharp -3.8% drop in crude oil. The session was again volatile with some of the early strong gains being lost after a Russian fighter collided with a US drone over the Black Sea. The S&P500 finally closed up +1.65% while NASDAQ significantly outperformed rallying +2.3%, Bitcoin rallied another 2% taking its recovery over the last fortnight to well over 20%, a great read-through for risk assets over the coming weeks.

- Following the gains, on overseas bourses, the SPI Futures are pointing to a solid opening this morning up around 65 points, or 1%.