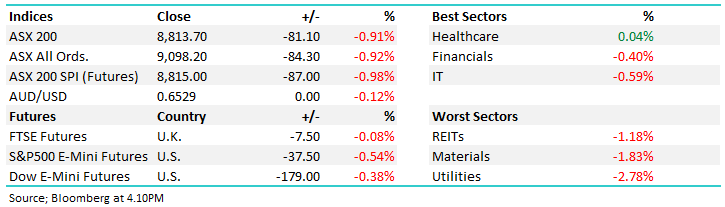

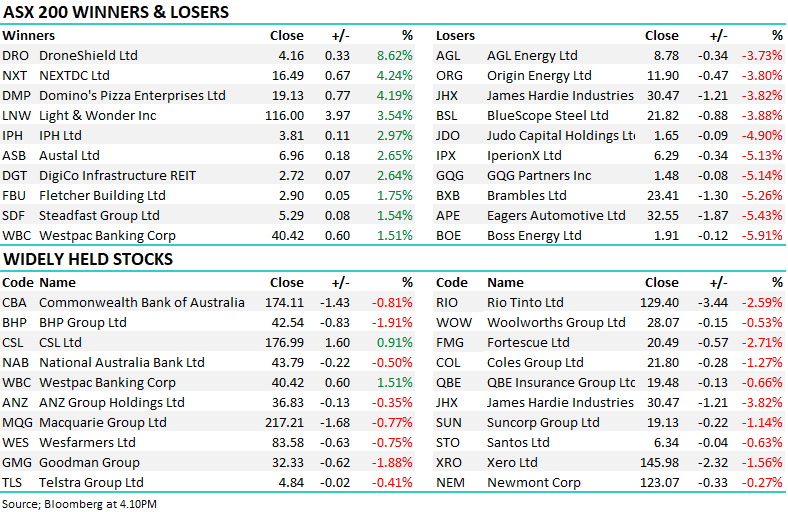

The ASX200 slipped -0.2% yesterday but in a similar fashion to US stocks on Friday we saw some buying surface into the close, especially through the futures. While the local market was down all-day only 55% of the main board closed lower although there was a negative undercurrent to proceedings as the Consumer Discretionary stocks continued to struggle, their woes were compounded by a bearish outlook from JB Hi-Fi (JBH) which saw the electronics retailer tumble over 5% – more on this later.

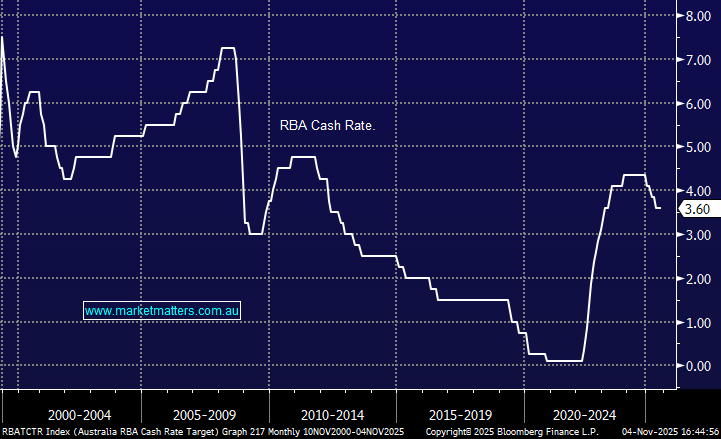

- As interest rates start to hurt the consumer we believe it’s too early to build meaningful exposure to the retail sector.

- Markets hate uncertainty and recent events have money markets and many everyday Australians second-guessing how far above the RBA will hike interest rates.

US stocks have not been impervious to rate jitters with the Fed now expected to hike US rates above 5%, last week saw the S&P500 endure its worst 5-day decline in 2 months but if tonight’s inflation data comes in at 6.2%, or dare I say it lower, financial markets could again be turned upside down. We saw overnight how growth stocks latched onto wage disinflation expectations i.e. these fell by the most in nearly 10 years, no great surprise as tech staff are being retrenched in their thousands – the NASDAQ rallied +1.6%.

- We believe if the US CPI on Tuesday comes in at 6.2% for January, down from 6.5% in December, it’s likely to undo some of the damage inflicted on bonds and equities by the recent Jobs Report.

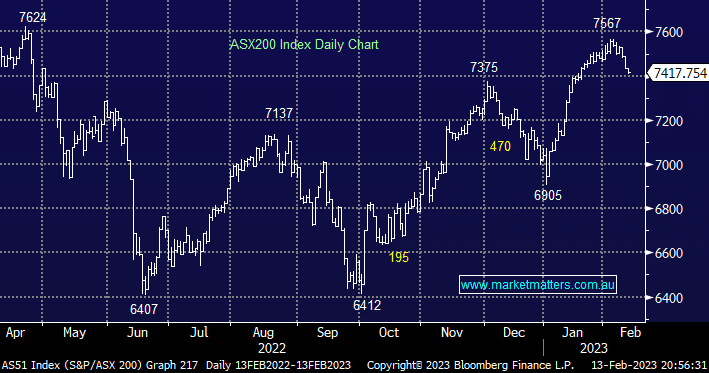

The market has only pulled back -2.1% from its 2023 high although it feels worse, primarily equities are rotating on the stock/sector level hence the underlying index appears reasonably comfortable at current levels. We’re only 6-weeks into the year and MM’s outlook that it’s going to be one that will be dominated beneath the hood, as opposed to major index swings, feels on point.

US indices rallied overnight with the S&P500 closing up +1.1% aided by a New York Federal Reserve consumer survey which showed inflation expectations little changed and as mentioned above wage expectations mellowing fast. Interestingly US 2-year yield still advanced to a new 2023 high in anticipation of a strong inflation print tonight but equities took the move in its stride, the SPI Futures are calling the ASX200 to open up +0.65% this morning, back around the 7460 area.

We’re sitting on a decent cash position in the MM Flagship Growth Portfolio hence when we saw a number of stocks drop by -4% or more on Monday MM was scouring the landscape for bargains, unfortunately as is often the case most stocks that were lower had delivered poor earnings numbers &/or news i.e. its usually more exciting to be a buyer when the whole markets falling as opposed to stock specific names.

In yesterday’s “The Match Out Report” we discussed JB Hi-Fi (JBH), Star Entertainment (SGR) and Lend Lease (LLC) from the naughty corner with none of them overly exciting us. Hence we’ve looked at 3 others this morning in an attempt to find some value.