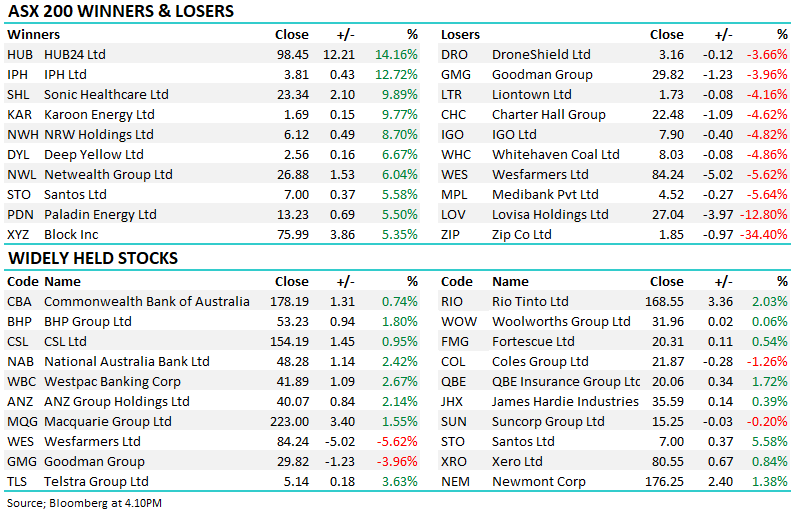

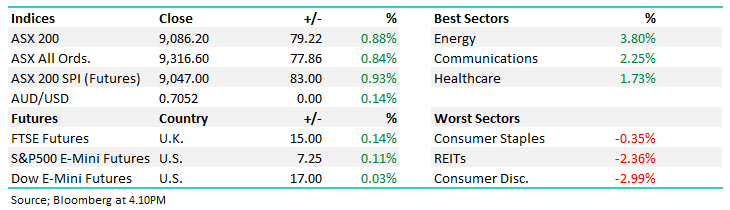

The ASX200 continues to find buying support into decent dips but it’s not yet got the stamina / belief to make any headway on the upside, yesterday saw the local market bounce over 50-points from a weak open, following an aggressive late downturn by US markets, but once it returned to unchanged the buying almost instantly became far more passive. Currently markets are transfixed on any fresh news around the Omicron variant and until we see the market hold firm on bad news the likelihood is we haven’t yet seen the end…