Thanks Marg,

Lower interest rates are theoretically a negative for bank margins, but there are a few moving parts here. When rates are higher, banks generally find it easier to beef up the difference between the cost of borrowing and the rate they lend at, and vice versa when they drop. This trend was flagged by a number of US banks recently i.e. lower bond yields starting to have an impact. The offset to that is usually better credit quality (i.e. less defaults) however these are at incredibly low levels anyway. As we saw with employment data during the week, things remain robust economically in Australia and with only around 3 rate cuts priced in, a strong labour market and more gradually falling inflation, we doubt rates will come down too hard and too fast, so this should not present a major headwind for the sector.

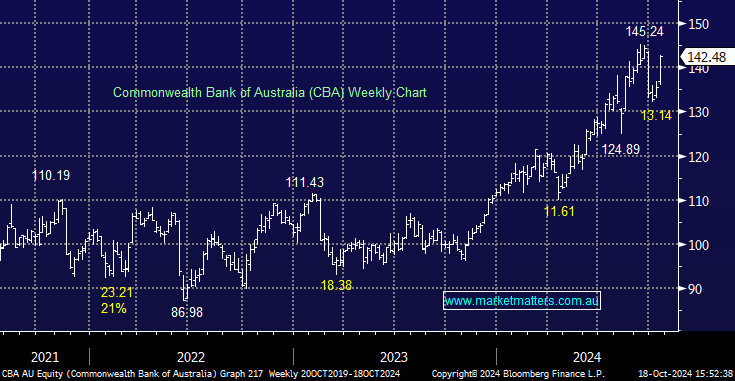

- We’re underweight the sector at the moment and that’s where we want to be as they trade at very lofty valuations. That makes us a buyer of weakness assuming the Aussie economy holds up, but not a seller of strength. If we held an overweight position, we’d be using strength to reduce it, with CBA looking on track to confound the analysts who are bearish and test $150.