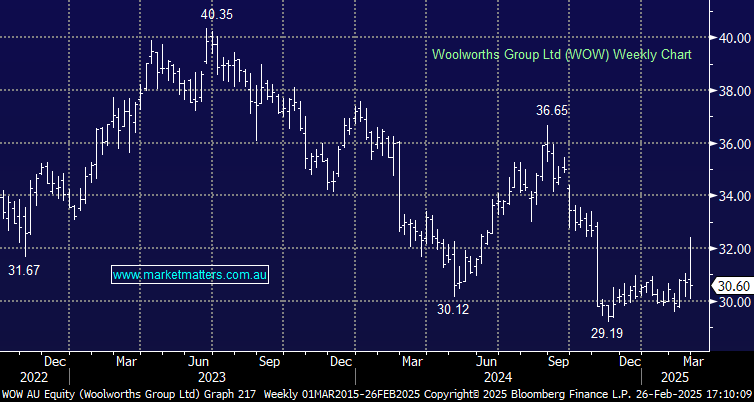

WOW –3.04%: Announced 1st half results below expectations, with earnings in the Australian food segment particularly weak.

- Underlying earnings before interest and tax (EBIT) of $1,451 million, -3% below consensus.

- Australian Food EBIT down 13% to $1,391 million.

- $400m cost out program announced

- Interim dividend 39cps vs. 40cps consensus

The cost out program was a positive surprise, and we suspect much of this will be implemented via a breadth of AI and other solutions from a logistics and operational perspective.

The market was ultimately disappointed with the second-half Australian food outlook with 2H food sales up 3.3% vs. forecast of 3.6%. Interestingly, we saw a turnaround in 1H from the NZ segment with EBIT of $82m, a 15% beat to expectations. This improvement aligns with the retail sales data we saw with quarterly NZ retail sales increasing 0.9% vs. survey of 0.5%.

With this in mind, NZ is 6 months into a rate-cutting cycle, we see reason to be optimistic about an improving Australian consumer given the pivot by the RBA, though we do note the significance of the speed and magnitude of the RBNZ’s move. We’ll wait to see further Australian consumer data before we make a definitive move.